Steeped Success: The Rise of Vodka Iced Tea

If there’s one ready-to-drink (RTD) style that got a summer glow-up, it’s vodka-spiked iced tea.

The trend was kicked off in the Northeast in 2022 by Surfside, a line of canned iced tea and vodka cocktails that infiltrated baseball stadiums and gave beer distributors a higher case-value win. Now, the demand for spirits-based iced tea is spreading nationally, inspiring major players to also look for opportunities in malt-based spiked tea trade-ups. Leading RTDs from High Noon to Boston Beer to independent brands are all now riding the spirit-spiked tea wave. In a sea of seltzers, the new segment has served the thirst from consumers for a new flavor and style – but what will it take for new competitors to make a splash and how long will the par-tea last?

A Serious Spike

At the end of 2023, the spirits-based tea flavored RTD segment was in decline, down 5.9% in off-premise sales, according to NIQ data assembled for BevNET by bev-alc data firm 3 Tier Beverages. That’s until Surfside gained traction, and Gallo and Boston Beer came along with their vodka-based tea offerings in spring 2024.

A family-owned and operated business, Surfside was founded by Philadelphia-born brothers Matt and Bryan Quigley alongside fellow Stateside Vodka founders Clement and Zach Pappas. The vodka distillers found a niche in premium hard tea and lemonade in the Northeast, which Pappas has ascribed to arriving at the right time with a non-carbonated option as consumers began to experience seltzer fatigue and graduate to more premium options.

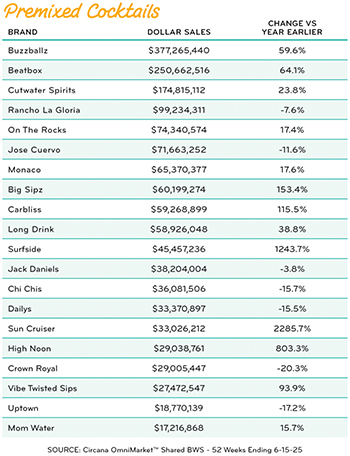

Boston Beer Company might have the No. 1 share of the hard tea segment with Twisted Tea, but in March 2024 it was forced to launch yet another tea brand, the first direct competitor to Surfside, via a 4.5% vodka-based hard tea, Sun Cruiser, which carried a higher price point than Twisted Tea and was aimed at a different consumer. Gallo’s High Noon followed in May 2024, launching its first non-carbonated line, a Vodka Iced Tea, also 4.5% ABV per 12 oz. can in four flavors.

In April 2024, Surfside pulled slightly ahead of its competitors, launching five new SKUs ranging from Green Tea + Vodka to Raspberry Tea + Vodka, and expanded domestic distribution to more than 40 states. Surfside became the fastest-growing premium spirits brand in 2024, adding 3.5 million cases (versus High Noon’s +3.1 million) and selling 4.7 million total cases, according to Jeffries analysts.

Surfside’s fast-growing trajectory didn’t just inspire Gallo and Boston Beer: spirits-based tea flavored RTDs have gone from 37 active UPCs in 2021 to 113 today. That’s a 205% increase in about four years, with sales up 700% during that same time frame, according to 3 Tier Beverage.

Single flavor UPC sales of spirits-based tea flavored RTDs are now ranked third overall in flavor (+291% in off-premise sales over the last year), making it one of the largest flavor trends in the RTD category, behind citrus and tropical flavors. Those 113 tea-flavored RTDs make up 3.7% of total active RTD UPCs, but account for 5.7% of overall dollar sales.

Competition Starts Brewing

Four brands now make up 97% of overall off-premise spirits-based tea flavored RTD sales, according to 3 Tier Beverage: Sun Cruiser, High Noon, Surfside and Good Boy Vodka Cocktails.

While all are experiencing tremendous sales and distribution growth, in a little more than a year since its launch, Sun Cruiser has captured one-third of off-premise spirits-based tea-flavored RTD sales, according to 3 Tier. Sun Cruiser was a driving force behind the 5.3% year-over-year shipments growth Boston Beer recorded in the first quarter of FY 2025, and the beer giant has plans to triple distribution this summer.

Surfside Tea’s off-premise share loss (off 13.7% in the last 52 weeks ending June 14) is a direct result of new Sun Cruiser (25.5% of share) and High Noon Tea (11.9%) offerings. However, the rest of the Surfside’s flavors are on the rise, and the brand is still achieving 296% growth at retail, according to 3 Tier. As it spreads west, Surfside’s co-founder Clement Pappas said the brand is on track to hit its yearly sales goal of 12 million cases.

Sun Cruiser and Gallo’s High Noon benefit from longstanding distributor networks and major trade-spend budgets that they can leverage to get products to shelves. To counter, Surfside is hedging its bets on driving discovery and “building an authentic connection” with consumers via its tried and true strategies, such as partnerships with baseball stadiums and music festivals.

“We’re looking more at the pull and generating that, and I think a lot of our competition is pretty focused on the push,” said Pappas.

Competition will only intensify, particularly from major players, according to Jeffries analysts.

Meanwhile, other competitors are leveraging a more typical hype strategy: a celebrity partner. Good Boy Vodka launched in 2023 in partnership with golfer John Daly, carving a niche at the golf course that bled into retail demand elsewhere. The company has also taken a broader retail approach from that of Surfside, which went deep in the Northeast before expanding. Good Boy has leveraged its celebrity partner and a charitable giving program to win over national retailers first.

“John actively promotes our John Daly Cocktails and has hosted numerous meet and greets at key retailers nationwide, helping us connect directly with consumers in each market,” said Alex Pratt, founder and CEO of Good Boy Vodka.

Other independent brands are eyeing a different trade-up opportunity. Owl’s Brew, a line of tea-based boozy RTD beverages made from organic ingredients, launched a Sun Tea line made with premium vodka and real brewed tea this summer.

“It’s quite literally freshly brewed tea, which is the biggest differentiator for us against everything that is in the market right now, so it’s really a premium version of what’s available now,” said co-founder Maria Littlefield.

Hard tea’s evolution from a flavored malt beverage (FMB) to a higher priced spirits-based offering could signal room for the segment to continue premiumizing. Even amid declining sales trends, FMBs (42%) and hard seltzers (25%) held onto the largest dollar share of the RTD segment compared to spirits RTDs (22%) and wine RTDs (11%) in the last 52 weeks, according to NIQ. But within RTDs, wine- and spirits- based offerings have performed the best in both dollar sales and volume trends.

“We’ve seen a shift within the hard tea category over the past one and a half years,” said Randy Ornstein, senior director of beverages at Gopuff.

While malt-based tea products were the most popular type of hard tea in Q1 2024, spirit-based entrants have quickly taken over, with spirit-based tea RTDs growing at a rate of more than 300% at Gopuff.

Room To Pour Into More Shelf Space?

As RTD shelf space tightens, spirits-based options with higher margins are also likely to claim more share from FMBs.

Spirit-based hard teas have played “a big role” in the overall expansion of the canned cocktail section at BevMo! and Liquor Barn, according to Matt Bardill, senior director of merchandising at GoBrands Retail.

When doing resets, the company is giving 20-40% more room to canned cocktails in order to allow hard teas and other RTDs to grow. The retailer also included spirits-based hard teas in their cold door schematic starting Spring 2025, with hard tea getting one to two shelves within the cold doors.

“We plan to further increase cold door presence as more single-serve spirit-based hard tea options become available,” added Bardill.

To date, spirit-based hard teas have seen the most growth on the East Coast, but over the past few months, Gopuff retailers have started to see a significant increase in demand in West Coast stores, too.

As the trend spreads west, and if legislation eventually opens more channel opportunities for spirits-based RTDs in various states, there’s likely still a good amount of room for the segment to grow. While off-premise sales for spirits-based hard teas clocked in at $156 million in the last 52 weeks ending June 14, FMB teas have nearly double the active UPCs, with sales of $680 million, up 10%, according to NIQ data analyzed by 3 Tier Beverage.

As of now, major brands are mimicking each other’s design and formula – Anheuser-Busch’s own vodka iced tea, Skimmers, debuted in April looking like a lovechild of the segment’s leaders. But new entrants without powerhouse distribution will likely need to come up with something different.

“Our customers come to Gopuff looking not only for their favorite products, but also to discover the latest and greatest, try trending items and find new products,” Ornstein said. “So, while we have a highly curated, relatively limited assortment at Gopuff, we’ll continue to keep an eye out for new innovations our customers will love. Specifically, we’re looking for exciting new products that are clearly differentiated and offer something unique or novel to our customers.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe