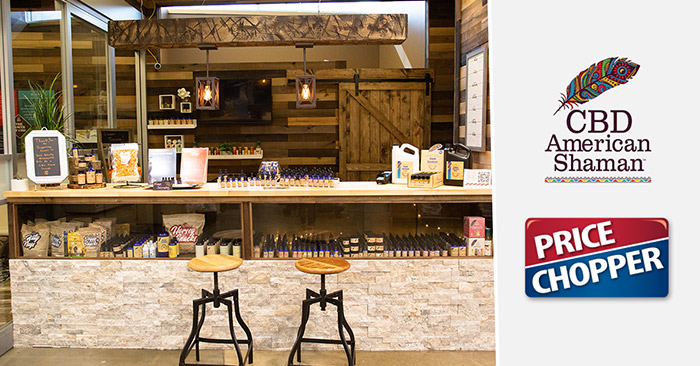

Although federal CBD regulations remain in limbo, some retailers are pushing forward to capitalize on consumer interest in the ingredient. This month CBD retail chain American Shaman opened its first ‘store-within-a-store’ concept inside of Kansas City, Mo.-based grocery store Price Chopper.

The store-within-a-store may later debut in the other 12 Price Chopper stores owned by local Kansas City grocery company Balls Food Stores, which owns a total of 26 grocery stores in the area. All 26 stores sell CBD products, but their employees have struggled to understand and explain CBD to customers, said Scott Bayne, Balls Food Stores VP of sales and marketing.

When the front-of-store space, formerly occupied by a credit union, became available earlier this spring, Bayne thought of American Shaman, having sold the company’s sparkling water and teas in Price Chopper locations for the prior two years. Founded in 2015, Kansas City-based CBD American Shaman (commonly referred to as American Shaman) is the most prominent local CBD company, Bayne said, selling candy, popcorn, cookies, sparkling water and more in over 400 stores across the country, as well as online and in about 20 c-stores.

The space presented an opportunity to boost the brand and better educate Price Chopper customers, Bayne explained. The U.S. cannabinoid market is expected to reach $45 billion by 2024, according to research firms IRI and BDSA, and for the 52 weeks ending June 14, CBD food and beverage sales were up 130% year-over-year. Bayne said the grocer wants to capitalize on the opportunity.

“We have to find ways to be at the forefront,” Bayne said. “How do we make sure we get our share?”

Already looking ahead, it’s highly possible that along with other Price Chopper locations, Balls Food Stores’ other banners will also launch CBD stores, he added.

“It’s an open-ended partnership — probably a year, but they can stay as long as they want,” Bayne noted. “If it’s working we’ll just keep doing it; because we’re family-owned we can do that.”

At the same time, the stores will continue to sell other CBD brands, he said, including Wyld CBD gummies and beverages, for example. Price Chopper will also continue selling American Shaman beverages on the grocery side, since the full store’s hours are longer, said Bayne. The separate store, however, owned and run by American Shaman, provides a better place for education around CBD, he said.

American Shaman founder and CEO Vince Sanders said he sees the partnership as a “lucrative business proposition.” In the agreement, American Shaman pays rent and funded and designed the buildout; Balls Food Stores receives a guaranteed overhead and additional percentage of American Shaman’s sales over a certain dollar amount. In return, Price Chopper will promote the store via ads and signage, said Bayne.

“We want to make it successful for them because we think it’s an added offering to our customers,” Bayne said.

So what does this do for CBD American Shaman, which already has stores across 38 states? The company started franchising in 2017, and its stores, mostly concentrated in Kansas, Missouri and Oklahoma, have been key to its growth, said Sanders. American Shaman is a “grandfather of the industry,” he said, noting 2019 was a “watershed year” in which the company’s revenue grew nearly 500-fold.

Despite a recent spike in ecommerce sales during the early weeks of the pandemic, the company reports that its in-store volume has also returned as stores came back online and ecommerce remains elevated. The Price Chopper store is expected to become a top location for foot traffic, with 160,000 grocery customers per month. The average foot traffic for an American Shaman store, meanwhile, is 270 shoppers per month, according to the brand. Most of American Shaman’s consumers are female baby boomers, Sanders said, correlating with Price Chopper’s customer base.

For CBD in particular, in-store experiences are important for customer retention, Sanders explained. Retail workers selling CBD “become an expert and friend” by helping customers manage pain, arthritis, stress and other issues. He added that for shoppers new to CBD, the “vast majority” prefer to go into a store and get face-to-face advice.

Sanders said food and beverage items are a big part of the company’s growth plan, noting their lower price points versus tinctures, for example, encourage trial. Already American Shaman produces over 160 SKUs, all of which are sold inside the Price Chopper store, including 29 food and beverage items. The company also plans to grow its c-store presence in the coming year starting with a special c-store product launch.

“I’m not sure everyone has the self-discipline to take a supplement,” he said. “The big market we feel is in easy-to-ingest [products].”

There’s also potential to begin developing a more in-depth channel strategy, Sanders said, with the franchise stores becoming more supplement-focused — like a pharmacy — while stores within grocery stores aim to reach newer consumers via food and beverages.

Despite a lack of codified federal regulation of CBD in food and drink, Sanders added that American Shaman hasn’t faced issues selling food products or operating stores for the past five years. Bayne noted that he visited American Shaman’s facilities to ensure they were clean and properly maintained.

“We open where we want to open; we just march forward,” Sanders said. “If there’s pushback we push back — that’s kind of how we are. So far it has worked really well.”