Girl Powered: How Energy Drinks Learned to Win with Women

If there is anything to be learned from energy drink deals in recent history, it’s that the need for caffeine is gender-agnostic.

Amid a slew of distribution partnerships, investments and acquisitions, the biggest successes in this past year have come to energy drink brands reaching toward female consumers. But it’s not just a pink can or a female-sounding name; the brands that win feature products that try to meet a variety of values and needs. These brands are winning more and more with female consumers, and that’s having a big effect on category growth, which has migrated from motocross rallies to pilates studios.

Those brands making gains with women address the misconception that the target energy consumer is monolithic. Instead, these energy drinks are homing in on fitness, wellness and healthy eating trends to tally wins that cross gender lines.

There are pretty clear examples of brands that see a lot of value in women as their primary consumers. Take Celsius, already a brand with a significant female customer base, which doubled down on that group in February with a $1.8 billion acquisition of Alani Nu, arguably the most prominent female-positioned energy brand.

The price tag might have been steep, but the pickup of Alani Nu signaled to the rest of the category that for Celsius, the future is female.

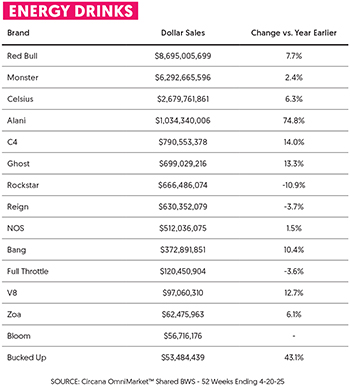

Alani Nu remains one of the fastest-growing energy drinks across demographics. The brand grew dollar sales 74% and unit sales 75% in the past 52-week period ending May 12, according to Circana MULO+C tracking data. Celsius, which has been in a bit of a slowdown as it reconfigures its relationship with PepsiCo, its distributor and part-owner, saw dollar sales elevate 6.3% as units rose 5.7%. The broader the energy category sales lifted 5.9%, with unit volume up 3.4%.

Pre-acquisition, Celsius and Alani Nu shared a common thread. Both brands established themselves within the active-lifestyle community, targeting fitness clubs as a foothold instead of the convenience channel, although with fitness influencer Katy Hearn as its creator, and a strong affinity for jewel-tone packaging, Alani Nu codes more distinctly female.

Flexing in Fitness

Energy drinks have always had a fairly broad use case, from morning wakefulness to afternoon pick-me-up to late-night party aid. There’s also been a strong crossover between caffeine and gym culture, with lots of fitness retailers offering up workout-focused beverages that are loaded with ingredients that are also common to energy drinks.

In recent years, energy drinks themselves started appearing in gyms, and several successful brands of the current generation – C4, Bloom, Bang, Bucked Up – were actually launched by founders hailing from the supplement industry. Some of the most successful brands have wedded those ingredients while making them approachable to consumers around their workouts – regardless of their gender.

“As energy drinks started showing up in health clubs, they were within arm’s reach of female consumers,” said Caroline Levy, a beverage industry advisor and board member of Health-Aid, Athletic Brewing and Celsius. “In the beverage industry, it’s all about being within arm’s reach.

The key was that the brands that took this path to build a following weren’t solely targeting women but were “appealing to a broader consumer than just male,” Levy said.

The energy drinks that have done that successfully have moved from the Red Bull & Vodka orientation or the extreme sports affiliation of Monster Energy to the workout-friendly, performance nutrition space.

In hindsight, it might seem obvious that there was a connection to active-lifestyle consumers seeking a better-for-you energy drink option. This second wave of energy drinks ushered in by Celsius took into account that there was a huge opportunity among the fitness community who need more energy but with less sugar and other functional benefits.

“It’s kind of absurd that it took so long,” said CPG industry consultant Joshua Schall. “It took a brand like Celsius to not necessarily speak to female consumers, but let them know it was a safe space to operate.”

That was the “spark,” Schall said, allowing a founder like Hearn to tap into the appeal of an energy brand targeting and founded by women. Hearn realized the connection between the sports nutrition and supplement space, built an energy drink on that base and found a wide-open track to grow.

Alani Nu’s strategy has become a template for other brands trying to tap into active ladies needing a pre-workout pick-me-up. Fitness supplement brand Babe By Bucked Up (the women-positioned offshoot of Bucked Up Energy) expanded its powdered offerings into canned energy drinks in April.

In November, Molson Coors took a majority stake in ZOA Energy, which has positioned itself as a fitness product, expanding its offerings into pre-work powders. Although its celebrity founder, Dwayne “The Rock” Johnson, is the most prominent ambassador for the brand, on social media platforms, the brand favors portraying women using the product.

From Fitness To Wellness

One of the most obvious places for female-oriented energy brands to flip the script on the category is branding and marketing. Warmer, brighter colors and fruit-forward flavors have shown to be successful in drawing women to the energy drink aisle, said Caroline Levy.

Formulations that use natural caffeine sources like green tea leaves and green coffee bean extract also speak to healthy eating trends. Many brands have also fortified with L-theanine, prebiotic fiber, biotin and other functional ingredients, calling out to focus, metabolism support, and improving skin and hair health.

“Part of this is that brands developed products women like, but the other part is that women have a lot more disposable income,” Levy said. “You’ve got an increasingly wealthy, female consumer base that are getting married later and they tend to be the people who are in gyms and looking for a lot of energy because they are still going out late at night.”

But it isn’t just young Gen Zers living in gyms that are looking for a midday boost coming from a can. Millennials and Gen X consumers are coming to the category looking for a better-for-you option that helps them keep up with balancing work and family lives.

If Alani Nu was built by a fitness influencer, Bloom Nutrition took it one step further by emphasizing the wellness community’s need for more healthy energy drink options. Founded by Mari Llewellyn and her husband Greg LaVecchia in 2019, the wellness brand built a stable base as a digital-first powdered nutraceutical and supplements provider.

With the backing of Nutrabolt’s minority investment and Keurig Dr Pepper’s distribution network, Bloom spent last year expanding its products into mass retailers, starting with Target and, soon after, Walmart. Along with its top-selling Greens, protein powders and pre-workout mixes, Bloom launched prebiotic sodas and Sparkling Energy.

Utilizing Nutrabolt’s “deep expertise and resources” helped Bloom develop a “female-forward product that was more approachable,” said Bloom VP of brand Erica Tam. In surveying its customer base, Bloom calculated that 88% of its consumers – many of whom are women – were asking for an energy option.

“Nutrabolt is a major player in the energy drink space, with C4 firmly positioned around performance and a predominantly male audience,’ Tam said. “While many energy drinks can feel intimidating in their branding, we saw a clear opportunity to serve the wellness-minded woman.”

Known for its gut-health supplements, Bloom used wellness trends to guide its formulation and be a foundation for the expansion into caffeinated drinks. Sparkling energy uses green tea and lychee extract to boost the metabolism while ginseng and L-theanine bring a calming effect despite the 180mg of caffeine.

By early indications, Bloom’s Sparkling Energy is quickly accumulating a significant sales base. The brand notched $56.7 million in sales in less than a year on the market, according to Circana data, surpassing more established players like Bucked Up ($53.4M), Mountain Dew ($51.7M) and PRIME ($42.8M).

Leveraging its Target partnership and KDP’s distribution power, Bloom increased brand visibility in-store in cold sets, ambient beverage aisles and off-shelf displays.

“Mass retail is a critical part of our long-term distribution strategy,” Tam said. “Our goal is to make Bloom as accessible as possible while maintaining a premium yet approachable brand experience.”

Conveniently Not Targeting The Convenience Channel

Gorgie is a testament to the ongoing potential of women as energy drinks consumers, landing a $24.5 million investment in April despite relatively small sales thus far. The approach isn’t gym-focused at all.

Founder Michelle Cordeiro Grant was no stranger to building a digital-first community with her Lively fashion empire. Cordeiro Grant sought a similar community of women consumers with Gorgie, offering a zero sugar option with 150mg of green tea caffeine with the added benefits of L-theanine, vitamins B6 and B12 and biotin to support healthy nails, hair and skin.

Instead of trying to compete for shelf-space among the Red Bulls, Bangs and Monsters in convenience, Gorgie stepped into retail by targeting natural and conventional grocery in key markets. Though the brand had some early hiccups moving from ecommerce into DSD distribution, it is starting to hit its stride.

Now, with a sizable war chest, it is going after the mass channel with a national launch in over 850 Target stores.

Big box retailers, grocery, and club stores have proven to be good channels for female-coded energy drinks – because this is where women are doing shopping for themselves and their families. (Let’s talk history for a second: despite generations of societal change from sufferage and no-fault divorce to Dolly Parton, the “Second Shift,” as coined by sociologist Arlie Hochschild, is real, with women more likely to be handling any number of household responsibilities even in two-earner families.)

Aspire Healthy Energy homed in on these channels early in its evolution. When the brand launched in the U.S., about eight years ago, it targeted channels like grocery and club “because, at that time, there was a much lower percentage of women shopping in convenience then there are today,” said Kim Feil, Aspire chief marketing and strategy officer.

Using club channel sampling opportunities, Aspire has been able to bring women to the category who were not energy consumers.

“Then they take home a 15- or 18-pack, which gives them two weeks’ worth of experience with the brand to build an individual habit,” she said.

Habitual consumption has been a key area for Aspire, which sees its target demographic in millennials. Feil cited that demand has come from first responders like emergency room workers, police or firefighters who drink energy drinks to stay alert for long shifts but are seeking options they can drink throughout the day.

About 48% of women say they prefer under 100 milligrams of caffeine in an individual serving, according to Aspire’s research, leaving the brand right in the middle of where demand is for female energy drink consumers.

“There’s room in this growing space of untapped need or unfulfilled need for multiple brands to succeed,” Feil said. “In essence, we find that women jump on our lily pad as their first experience in energy [drinks] because 80 milligrams is what they’re used to having.”

Last March, Aspire redesigned its packaging and launched a marketing campaign specifically tailored to women consumers. The new look not only brought brighter colors to the design but also concentrated its messaging on the drink’s formulation of lower caffeine and zero sugar.

Something For Everyone

The segmentation of the category into “subcohorts of consumers” that are seeking a more female-friendly energy drink shows the “substantial opportunity,” Schall said. “These brands are trying to figure out, do we fit into a beauty-nutraceutical angle or a more holistic wellness approach? Or is gym and activity more important to our consumers?”

One thing that’s clear is that this wave of brands believes it has an edge on more male-coded incumbents like Monster and Red Bull. It has taken years and a lot of reboots, but Monster has finally moved closer to an inclusive approach with its Reign Storm brand. It has tried a variety of angles, adding female athletes, performers and celebrities as brand ambassadors, attempting to establish a deeper connection to women.

Even Red Bull has signalled it can marry its extreme sports positioning to female consumers. Last year, women mountain bikers competed for the first time in its Rampage event in Utah.

What does seem to be working across demographics is swapping out the high-sugar for sweetness in a different package. Represented in Bang, Ghost or C4 zero-sugar options that still scream “sweet treat”, with candy flavors like Sour Ropes, Warheads and Jolly Rancher candy flavors.

But these energy drinks are not calling out to consumers seeking better-for-you options and they certainly are not marketing toward moderate caffeine users.

When Ariana Farahani began developing her energy drink brand Plant Press, much of the impetus was to develop an option that didn’t rely on artificial sugars or sugar alcohols to carry flavor.

“All the products were scary to pick up on the shelf,” she said. “I realized there were so many people out there like me who were not energy drinkers, but wanted a replacement to their afternoon coffee.”

Plant Press uses agave and monkfruit as its sweeteners, zagging from the zero sugar trend but offering a caffeinated drink with 3g added sugar and 20 calories. The three varieties (Watermelon, Passionfruit Peach and Grapefruit Ginger) have 100mg of caffeine and are fortified with electrolytes and vitamins to add health benefits.

Farahani formulated Plant Press with ingredients like folic acid, a B vitamin commonly taken as a supplement by pregnant women to support prenatal nutrition, and selenium to aid mood-regulation.

While some of the ingredients do skew more towards women, the brand is riding a “generational shift” in the category, Farahani said. “The current energy drink market is really broken, and there are both men and women and an entire subset of people that are looking for products that are gonna contribute to their lives, their health and allow them to feel their best.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe