Consumers are searching for new forms of convenience, whether as clever packaging or new products, and prioritizing exciting and unfamiliar flavors at mealtime, according to market research firm IRI’s annual New Product Pacesetters report, released yesterday. The report also recognized no and low sugar claims influence on driving consumers to not only try, but also repeatedly purchase a product.

According to the report, the U.S. CPG market’s growth decelerated compared to its mid-pandemic boom, growing at a rate of 2.6% over the course of 2021 versus the 10.7% increase reported last year. As consumers began experiencing “life outside of the home” again and “the world learned to live with COVID-19,” convenience and indulgence both took priority as consumers aimed to “ease the pressures of life,” the report states.

This year’s top ten pacesetters were determined by data such as dollar sales, repeat purchases, media spend, among other factors and was heavily dominated by beverage brands, specifically RTD cocktails like Corona Hard Seltzer, High Noon Sun Sips, Truly Iced Tea and Michelob Ultra Organic Seltzer.

Outside of the spiked segment, Dr Pepper & Cream Soda took the number one pacesetter spot, generating $137.7 million in sales and a 50% repeat purchase rate. Coca Cola’s AHA seltzer brand took second with $128.6 million in sales and 51% repeat purchases. According to the report, the success of these two products was largely due to their respective flavor combinations. Additionally in the beverage set, Oatly claimed fifth place and Minute Maid Zero Sugar ranked in at number ten.

Only two food products made it on the top ten list: The Impossible Burger and Life Cuisine frozen meals, which came in eighth and ninth place, respectively. Despite the lack of presence among the top spots, food products that served up more convenient cooking experiences, like meal starters, kits and sauces, garnered significant interest and loyalty among consumers this year and were plentiful in the full report which includes over 200 brands and products.

“Our data indicates that consumers are eager to explore new flavors in food and beverage, in large part to make their at-home cooking experiences easier and more exciting,” the report states. “Despite an easing of the pandemic, approximately 80% of meals are made at home versus 48% pre-pandemic. New food and beverage products with unique flavors help “spice up” the at-home experience.”

While consumers began to grow accustomed to living with COVID-19, elevating at-home experiences remained in focus, but priorities shifted away from the scratch cooking and toward new forms of convenience like RTD cocktails, innovative packaging and easy to prepare meals with unique flavor profiles. According to Joan Driggs, IRI VP of content and thought leadership, consumers are looking for easier ways to experiment at mealtime while still maintaining “ownership in the outcome.”

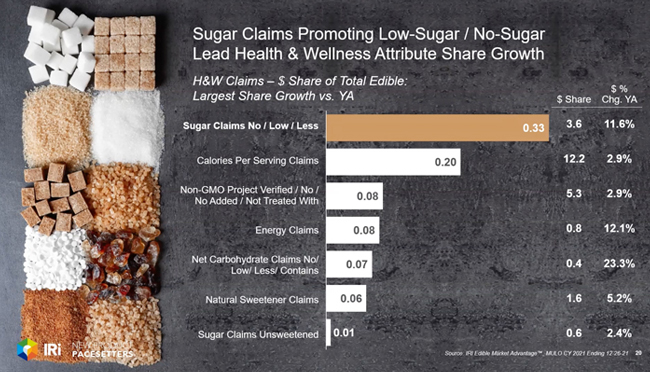

Among health and wellness related tenets, low or no sugar claims played a key role indicating that consumers are looking to tone down sugar consumption without entirely forgoing indulgent occasions, the report states. This spurred 12% dollar sales growth, for both food and beverage brands that prioritized sugar claims. Brands that honed in on the no or low sugar callout saw dollar sales outpace the growth of products with other health related claims, according to the report, including callouts for unsweetened or natural sweeteners, calorie per serving statements and low to no net carbs.

The importance of health and sustainability saw plenty of crossover with continued rise of plant-based products in both food and beverage as well. According to the report, plant-based attributes are one of the leading attributes spurring consumer brand loyalty and the report found that Oatly and Impossible Foods are currently leading that pack. However, Driggs also noted that water reduction and carbon footprint reduction are of growing importance to younger consumers, specifically, and were among the top sustainability-related claims this past year.

“We know these younger generations, which might not have the spending power of older generations,” said Driggs. “They’re more demanding when it comes to sustainability. We see this in current product innovation and believe it will be more foundational and new products moving forward.”