Gold Dust: Powders are Powering Innovation from Hydration to Beyond

It’s a good thing that powder drink products don’t take up too much space on the shelf — the category needs all the room it can get.

In this golden age of functional beverages, the driest format may finally be getting its due. Convenience and versatility have always been part of the appeal of the mix-to-drink format, but a confluence of supporting factors – sustainability, variety, a subscription-friendly model and just some good old fashioned cool branding, to name a few – have made powders arguably more attractive than ever, if also more competitive. Whether at Target, Erehwon, online or grab-and-go, powders are powering brands on the quest to capture more consumers.

High On Hydration

In 2024, consumers are looking for hydration anywhere they can find it.

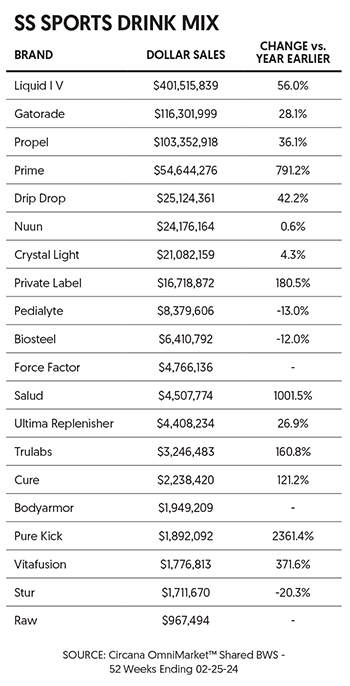

That enthusiasm has lifted the powder category overall: dollar sales for sports drink mixes were up 53% year-over-year through March 26, 2024, with average price increasing 24.2% and volume rising 23.2% during the period. Gains were driven by the strong performance of brands like Liquid I.V. (Unilever) and Gatorade/Propel (Pepsi), but next year’s results may look quite different: several heavy hitters entered the space over the last six months.

These new names – highlighted by Liquid Death, BodyArmor and Electolit – reflect both consumer interest in hydration and the imperative for brands to establish some level of presence in the powder category. Liquid Death’s take has been typically irreverent: Death Dust, currently available on Amazon for $17.99 per 12-count variety pack, adapts three of the most popular flavors from its sparkling waters – Severed Lime, Mango Chainsaw and Convicted Melon – into electrolyte drink mixes. For Electrolit, which is distributed by Keurig Dr Pepper, and BodyArmor, owned by Coca-Cola, stick packs represent a quick route to extending their respective brands’ reach. According to Circana data, BodyArmor has done nearly $2 million in dollar sales since introducing Flash I.V. Hydration Boost sticks in September 2023, while in March Electrolit partnered with 7-Eleven to launch a variety 12-pack of its powders, having debuted the line on Amazon last year.

Don’t forget fast-rising disruptors like PRIME, either. BevNET’s 2023 Brand of the Year has grappled with inventory issues with its RTDs, making the over $54 million in dollar sales from its drink mixes (+791.2% year-over-year, per Circana) all the sweeter. Another all-caps brand, GHOST, is similarly positioned, but its range of powder products is already more robust, covering use occasions from hydration to pre-workout, protein and pump. Its energy drink continues to put up massive numbers, but GHOST’s recent jump into hydration RTDs in 16.9 oz. PET bottles could boost demand for its powder sticks in conventional retailers.

While the category is full of powdered versions of existing RTDs, Austrian brand waterdrop offers a progressive take on what a brand that’s fully committed to the format can become. The company has supported its online sales with the creation of dedicated boutique-style stores in Miami, Los Angeles and the Mall of America (Minnesota), where its complete suite of SKUs and accessories are showcased in attractive displays like makeup or beauty products. But it’s also taking steps towards the mainstream: waterdrop’s recent packaging revamp for its 12-count and 3-count packs is designed to more clearly define its benefits and use cases, an important change as it steps into brick-and-mortar chains like Walgreens, Walmart and H-E-B. The brand’s Microlyte line — boasting a large dose (2 grams) of electrolytes in flavors like Blueberry, Grapefruit and Melon — is expected to drive sales in those retailers.

Optimism around the category’s growth potential may be spreading. After enduring a challenging few years following its IPO, Laird Superfood has stabilized its business in powdered coffee creamers and mixes while making strides towards profitability under the leadership of CEO Jason Veith. Elsewhere, retired NFL superstar Tom Brady is now in business with beverage kingmaker Mike Repole after the merger of Brady’s TB12 sports nutrition brand, which markets protein and hydration powders, and Repole’s sportswear company No Bull in January.

Functionality Broadens, Premium Emerges

As modern consumers continue to take a more holistic approach towards fitness, nutrition and overall wellness, powder brands are eager to help them at each stop along the way.

That’s one of the reasons why Nutrabolt, maker of the popular C4 brand, took a 20% stake in online supplement business Bloom as part of a $90 million capital infusion in January. With pre-workout and recovery occasions covered by C4 and its other banners (XTEND, Cellucor) in retailers like Vitamin Shoppe and GNC, Bloom’s portfolio — driven by Greens and Superfood lines, the former the top-selling U.S. product in its category — gives Nutrabolt a presence at mass retail chains like Target, which highlighted supplements and hydration as a significant piece of the 1,000 new wellness products introduced to stores in February.

“Nutrabolt wants to build the health and wellness version of The Kraft Heinz Company,” commented Joshua Schall, an industry consultant and BevNET contributor. “While some portfolio expansion might come from internal brand development, I believe most will happen because of accretive deal making that extends Nutrabolt into more key consumer-driven wellness platforms. So, Bloom might mark Nutrabolt’s first minority investment, but I don’t see it being the last.”

That thesis may be playing out at Target, which has made functional powders part of its bid to recruit players from hot wellness segments like non-alcoholic beverages. Even within a category where brands frequently offer similarly positioned products, the retailer has been eager to make space: Canadian supplement maker Blume (not to be confused with Bloom) introduced four SKUs of its organic functional superfood lattes to Target in February before launching a completely new product — SuperBelly, a gut-friendly hydration mix — that same month.

For brands like Blume (4,000-plus U.S. stores), validation at retail proves that digital-native powder brands can turn their social media traction into tangible gains in accessibility, both in number of doors and ability to stretch across price points. Making its national retail debut in February, California-based brand Clevr introduced smaller 8-count bags of its SuperLattes (Matcha, Coffee, Chai, and Sleeptime) exclusively for Target, priced at $17.99; online, a single 12 oz. bag (14 servings) costs $28 plus shipping.

Powder products also seem to be perfectly suited for the age of TikTok, where sharing different creative use occasions and recipes is a reliable path to going viral. That growing awareness has in turn helped make powders a vehicle to translate niche health trends and ingredients to a wider audience. This year, the influential L.A. natural grocery chain Erehwon’s Tonic Bar locations have teamed with Vital Proteins to integrate its collagen peptides into celeb-approved smoothies like Winnie Harlow’s Island Glow and Hailey Bieber’s Strawberry Glaze. The store was also the launch partner for The Absorption Company, a new company founded by actors Ian Somehalder and Nikki Reed that offers a full range of stick-based supplements – Restore, Energy, Sleep and Calm – differentiated by Capsoil, a proprietary delivery system for liposomal absorption that boosts bioavailability by up to 500%, the company claims. An order of two 7-count boxes (14 sticks total) costs $40 online.

A diversified field means both opportunity and obstacles lie ahead for the category. And among the brands that find success, some will surely start to look beyond powders for sources of further growth. One of those may be Nashville-based BEAM be amazing, which announced a strategic partnership with Dole Food Company in February that will enable the fruit and produce supplier to “further broaden its reach into new categories in the health and wellness sector,” starting with a co-branded version of its popular Super Greens. But BEAM’s latest innovation — Greens On-the-Go in 12 oz. cans, its first RTD — is the one that we’ll be watching a bit closer.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe