Ever since Diageo’s acquisition of Casamigos made George Clooney a billionaire overnight, there’s been a race to the shelf from celebrity-backed brands. But with the wider spirits downturn, how have these business models evolved and where do they have an edge, if at all?

Ever since Diageo’s acquisition of Casamigos made George Clooney a billionaire overnight, there’s been a race to the shelf from celebrity-backed brands. But with the wider spirits downturn, how have these business models evolved and where do they have an edge, if at all?

Attaching a celebrity to a brand might promise instant notoriety, but that’s not always the case. About 80% of shoppers cannot match celebrities to the brands they own, according to a recent report from Numerator, a retail data provider. Still, the celebrity factor helps get to market, as the percentage likely looks different among retail buyers. That’s the case at Total Wine & More.

“If I have two identical brands and one of them has a celebrity or an influencer and the other one doesn’t, the one with the celebrity and influencer does get some preference,” said Andrea Starr, senior director of merchandising for beer, ready-to-drink, and non-alc at Total Wine & More.

But amidst the proliferation of celebrity brands, a hierarchy has emerged. Starr evaluates the brand based on its tier of celebrity, its demographic and geographic hold, and how the company plans to engage that celebrity: it’s important to consistently connect the celebrity name to the brand via social media engagement and marketing, and appearances help.

That engagement is crucial because consumers are savvier and have increasingly fast access to information, even compared to just a decade ago. That also means there are more eyes on the behavior of celebrities, from more serious issues to themes of authenticity. (Although we should note that even several assault charges haven’t necessarily slowed down some brands).

“If a celebrity is really just truly slapping their name on the label and never engaging with the brand on a more organic level, people will see through it,” said Kyle Fitzpatrick, senior director of emerging CPG brands at Numerator.

So what does the data say about the types of brands finding success?

Mid-Tier, Non-Alc Growing

Off-premise dollar sales for nearly 100 brand families (92) celebrity spirit or spirit-based ready-to-drink brands are together down -3.5% in sales (to $922 million) and up 16.2% in volume over the 52 weeks ending May 18, according to NIQ data compiled by 3 Tier Beverages.

Many of the top brands will come as no surprise: companies like Casamigos and Dwayne Johnson’s Teremana Tequila are backed or owned by strategics and some of the world’s biggest celebrities across demographics. But three of the top ten growth brands are also in the top ten based on dollar sales: Miles Teller’s Long Drink, Teremana, and Lil Wayne’s Bumbu. Cîroc and fighter Saul “Canelo” Alvarez’s VMC make it to the top ten when ranked on volume sales as well. The top growth brands in dollars rank as follows:

- Long Drink (Miles Teller)

- Teremana (Dwayne Johnson)

- VMC (Saul “Canelo” Alvarez)

- Delola (Jennifer Lopez)

- Flecha Azul Tequila (Mark Wahlberg)

- Gin & Juice (Snoop Dogg & Dr. Dre)

- Bumbu (Lil Wayne)

- The Sassenach Gin (Sam Heughan)

- Sprinter (Kylie Jenner)

- The Sassenach Whiskey

Super premium brands (51%) make up the majority of dollar mix, followed by ultra (23%) and premium (19%) following. The growth, however, is coming from mid-tier brands, up 88% in the last 52 weeks prior to May 18 compared to the same period last year, led by Long Drink, Sprinter, Skinny Girl, Vosa and White X. The premium tier is up 6% with Teremana, VMC, Gin & Juice By Dre and Snoop, Proper No 12, and Lyre’s on top.

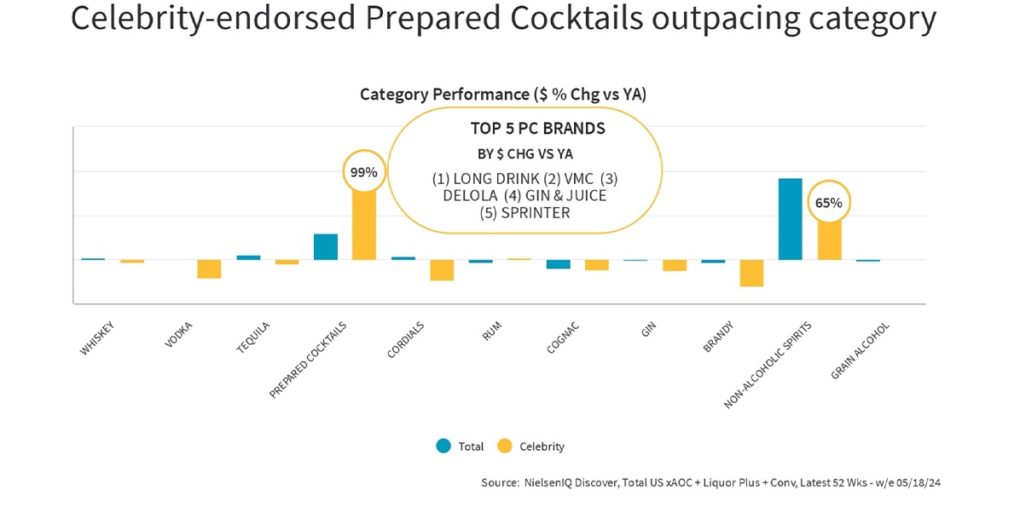

As for categories, celebrity brand dollars are overwhelmingly coming from tequila (59%), followed by vodka (11%), cognac (10%), prepared cocktails (9%), whiskey (6%), rum (3%) with gin and cordials (1%) and NA (0%) barely tracking.

Growing categories mirror larger trends: a few celebrities have embraced non-alc spirits, such as Katy Perry, Blake Lively and Lewis Hamilton, making up less than 1% of celebrity brands but growing by 65% in the same data period. Female-backed brands – up 41%, though they represent only 3% in dollar sales – are also catching up to what has traditionally been a man’s game, with Jennifer Lopez’s Delola and Kendall Jenner’s 818 Tequila in the lead.

With RTDs the fastest-growing spirits format, celebrity-backed ventures in the category are also making their mark: celebrity-backed RTDs have grown 99% since the same time period last year, outpacing their civilian counterparts. On top are Long Drink, VMC, Delola, Gin & Juice By Dre and Snoop, and Sprinter.

RTDs Gaining Momentum

With several of the celebrity-backed RTD brands launching in the last year, part of their momentum may still be from trial. Unlike celebrity brands joining the spirits shelf now, these names are among the first in the coldbox.

“We’re not seeing a ton of big names— we’re seeing a lot of brand partnerships, using the celeb as the endorser, but actually owning the brand, there’s definitely fewer proper celebrities,” said Starr of her department.

Kylie Jenner’s Sprinter was one with a “really strong launch,” at Total Wine & More, and Starr added that “there’s potentially some sustainability there.” Overall, the brand has shipped over 140,000 cases and hit 10,000 retailers and bars since March (it also secured a multi-million investment from a backer of Long Drink, Penta’s Ventures, and K5 Global).

Other canned brands that have found repeat business on the Total Wine & More shelves have had more history: Happy Dad Seltzer and Loverboy, for example, which “speaks to the celebrity’s continued engagement with the product,” Starr said.

For now, it’s too early to tell if Sprinter can bring in net new buyers versus stealing from competitors and sustain awareness (Sprinter is one of several product lines Jenner has dropped recently). With RTD concepts and liquid now among the simpler or faster spirit products to get to market, it’s possible more celebrities will follow suit— or we may find other names trying to wield their influence.

Influencers Influencing

The models for celebrity businesses have also evolved over the years, in some cases fueled by incubator-like portfolios. Models now include the celebrity owner who lives and breathes their brand; the celebrity that invested and has pushed the brand to new heights; and brands that gave up some equity and got a celebrity to sign a service agreement to show up at tastings and promote the brand.

The latter may be a costly risk for emerging brands, or the celebrities themselves. There are also models like Big Nose Kate, where celebrity investors make up just one of the compelling components of the business, but don’t take center stage.

Other models have popped up as social media influencers have expanded their reach. Pink Reef, the parent company of RTD Chido Premium Tequila Cocktails, is building its business model around quickly bringing influencer brands to market. It’s not the first company to trial influencer-backed brands in RTDs, but its long term-plan is to build brands with similar liquid propositions that each live in their own small cohesive ecosystem.

Pink Reef’s first product, Have A Day, was for Bob Does Sports, a golf entertainment brand. The first direct-to-consumer launch for the RTD in May sold out in 24 hours, as did the second. The company now has 15,000 cases committed to market launches with New York and Florida appearances scheduled for this summer.

The brand’s Instagram handle has grown to 74,000 followers since May — not an easy feat for new brands, and shows the power of an influencer’s ability to immediately tap into an audience.

From a lifecycle perspective, Brent Wetmore, VP of national accounts for Pink Reef, said the company views Have A Day as having a 36 to 72-months cycle at a minimum, which means Pink Reef might not be looking to build the next High Noon, but just support adding a line of canned tequila cocktails to an influencer’s ecosystem of social content, merchandise, and events.

“We have a lot more brands within the influencer space, and some of those brands have started to grow beyond the influencer reach, which is great, so really establishing a true brand that has a strong growth trajectory,” said Starr.

Those brands initially may get a little more scrutiny from a retailer, said Starr, around their follower counts, partnerships, and demographic to determine how they can create constant consumer acquisition beyond trial.

“It’s really understanding is this the influencer’s first step into CPG or branded products, or are they established with products and growing brands? Because that can help inform what we do,” she said.