Bevscape: The Latest Beverage Brand News

Spindrift Sold to PE Firm Gryphon Investors; Dave Burwick Named CEO

Spindrift has sold. The company reached an agreement for San Francisco-based private investment group Gryphon Investors to acquire a majority stake in the sparkling water brand, and tapped experienced CPG executive Dave Burwick as its new CEO.

The deal, expected to be closed sometime this spring, will see Spindrift founder and current CEO Bill Creelman retain a “significant equity stake” in the company while shifting into a new role as chairman of the board.

Creelman will be joined on the board by Ryan Fagan, managing director at Gryphon, as well as Gryphon partners Matt Farron and Mike Ferry.

Founded in 2010, Massachusetts-based Spindrift hit its stride after early experiments in craft soda evolved into its flagship product: sparkling water blended with fresh squeezed fruit juice, a concept that proved a hit with consumers and retailers seeking a differentiated product within the saturated category. Over the 52-week period ended December 28, 2024, Spindrift dollar sales totaled over $275 million while volume increased 22%, according to Goldman Sachs analysis of NielsenIQ data. The brand has also dabbled in innovation, including Spindrift Spiked hard seltzer.

A Wall Street Journal story in December indicated that a deal with Gryphon Investors could be valued above $650 million.

“I’m incredibly proud of what we’ve built at Spindrift over the past 15 years,” said Creelman in a press release. “For this next stage of growth, we looked for two things: a leader who could understand our business and the brand as natively as the people who work here today and an investment partner with the right financial and operational resources to galvanize our market leadership.

“I have known and respected Dave for nearly a decade, and with his experience and Gryphon Investors’ expertise, I’m confident that we will continue to have tremendous success in growing the brand and inspiring consumers to choose beverages that are based on the belief that the best tastes come directly from nature.”

In tapping Burwick, who came on board in February, as CEO, Spindrift is bringing in deep executive experience with large CPG brands. In addition to two decades at PepsiCo, Burwick has served as president and CEO of both The Boston Beer Company and Peet’s Coffee, as well as president, North America at Weight Watchers. During his tenure at Boston Beer, which concluded last February, he helped develop Truly Hard seltzer into a billion-dollar brand.

“I’m excited to join this dynamic team,” said Burwick. “Spindrift’s combination of talented professionals, superior products, and loyal customers has created a fantastic brand with a great future — one I can’t wait to be a part of.”

Gryphon Investors’ portfolio includes CPG brands like Dessert Holdings and Eight O’Clock Coffee, as well as investments in other industries.

“Spindrift has a strong, beloved brand and differentiated product portfolio because it’s made with exceptional thought and care,” said Fagan. “This attention to quality underlies the company’s outsized share of growth across beverage categories — nearly tripling in size since 2020 — and it’s what attracted us to invest in the business. We are thrilled to be partnering with both Bill and Dave, as well as the entire Spindrift team.”

Morgan Stanley & Co. LLC and Lazard acted as financial advisors to Gryphon. Simpson Thacher & Bartlett LLP and Morgan, Lewis & Bockius LLP acted as legal advisors to Spindrift. Piper Sandler and JP Morgan acted as financial advisors to Spindrift.

PepsiCo Acquires Poppi in $1.95B Deal

PepsiCo announced in March it has entered a definitive agreement to acquire Poppi for $1.95 billion, officially bringing the CSD giant into the next-gen functional soda set.

The deal includes $300 million of anticipated cash tax benefits, bringing the net purchase expense to $1.65 billion, according to PepsiCo.

“We’ve been evolving our food and beverage portfolio over many years, including by innovating with our brands in new spaces and through disciplined, strategic acquisitions that enable us to offer more positive choices to our consumers,” said PepsiCo chairman and CEO Ramon Laguarta in the press release. “More than ever, consumers are looking for convenient and great-tasting options that fit their lifestyles and respond to their growing interest in health and wellness. Poppi is a great complement to our portfolio transformation efforts to meet these needs.”

In a statement shared with BevNET, Poppi CEO Chris Hall praised the brand’s founders, Allison and Stephen Ellsworth, on their work creating the brand.

“The growth Poppi has experienced in just five years is unprecedented,” Hall said. “It has been an honor to work alongside the Ellsworths, the Poppi team, and our partners as we created a leading brand, a movement, and a community like no other. I am thrilled to enter this next chapter with PepsiCo as they support our continued growth and innovation and broaden our availability.”

Alongside Olipop, Poppi has been a leader in the prebiotic soda trend that has upended the CSD category with low sugar, functional products. According to NielsenIQ, U.S. retail dollar sales of Poppi were up 167.3% in the 52-week period ending January 11 to over $359.9 million, and volume sales grew 178.2% in the same period.

Founded as an apple cider vinegar drink called Mother Beverage, Poppi rebranded to its current version following an investment from Rohan Oza and CAVU Venture Partners after an appearance on Shark Tank.

Prior to the deal, Pepsi pulled the plug on a relaunch of its Soulboost brand, which would have been a play to compete in the prebiotic soda space.

The conglomerate is now poised to compete in the category against Coca-Cola (Simply Pop) and Keurig Dr Pepper (Bloom) as well as independent brands like Olipop and Culture Pop, the top- and third-best selling brands in the category. Big Geyser will remain as Poppi’s exclusive distributor in the New York City metro area.

The transaction is subject to regulatory approval and other customary closing conditions.

Celsius Acquires Alani Nu for $1.8 Billion

What a quarter! Celsius Holdings announced in February it has agreed to acquire competitor Alani Nu for $1.8 billion, comprising a mix of cash and stock. The transaction includes a potential $25 million earn-out based on 2025 performance.

The deal comes roughly 1 1/2 year after Reuters reported the performance energy drink brand was exploring a full or partial sale of the company at a valuation of over $3 billion.

“We have deep respect for the strong community of supporters and fans Alani Nu has developed and the authentic brand and partnerships they have formed. Together, we expect to broaden the availability of Alani Nu’s functional products to help more people achieve their wellness goals,” said John Fieldly, chairman and CEO of Celsius, in a statement.

Upon closing, Alani Nu will operate within Celsius, and key members of Congo Brands’ leadership team will continue as advisors to Celsius to “ensure continued business momentum,” per the announcement. The brand was previously operated by Congo Brands, which also runs Logan Paul’s PRIME.

Founded in 2018, Alani Nu has been among the fastest-growing brands in the better-for-you performance energy set and over-indexes with women. Retail sales of the brand in total MULO Plus with convenience climbed 78% year-over-year in the four-week period ending January 26, according to Circana.

As well, Alani Nu’s dollar share for the same four-week period was 4.8%, an increase of nearly 200 basis points from the prior year period.

With the addition of Alani Nu, the combined Celsius platform is expected to drive approximately $2 billion in sales across a portfolio that is aligned with the continued consumer shift toward premium, functional beverages catering to active lifestyles. The transaction is also anticipated to be accretive to cash EPS in the first full year of ownership.

The news came after Celsius posted a 33% drop in North America during Q3, partially driven by previously announced inventory cuts by distribution partner PepsiCo as a result of supply chain optimization. However, Fieldly expressed confidence that the conditions have “largely stabilized.”

“We believe Celsius can unlock key growth opportunities for Alani Nu and are excited to partner with John and the Celsius team as they continue to disrupt and grow the functional beverage space,” said Max Clemons, co-founder and co-CEO of Congo Brands, in a statement.

Dairy Farmers of America Accuses Westrock Coffee of Trade Secret Theft in Lawsuit

Dairy Farmers of America (DFA) has accused Westrock Coffee Company of poaching talent and stealing trade secrets in a lawsuit filed late last year.

The leading U.S. milk cooperative, which provides co-packing services for RTD coffee beverage brands, alleged that Westrock, a private label coffee and tea manufacturer of poaching talent and stealing trade secrets in a lawsuit filed in November in the United States District Court for the Western District of Missouri Southern Division.

The complaint also names six former DFA employees, now employed by Westrock, as codefendants, all of whom are cited for alleged breach of contract for supposedly violating non-disclosure agreements. They include food safety leader Brian Izdepski and Rebecca Huckabay, previously DFA’s manager for forecasting and scheduling and now an assistant plant manager for Westrock. Dustin Slagle, Cedric Smith, Patricia Bethurem and Julia Isakson were also named in the suit, though their respective roles were not immediately clear.

According to the complaint, a whistleblower – identified only as a current Westrock employee – first informed DFA of the alleged trade secret theft on May 6, 2024.

The tipster claimed the aforementioned former DFA staffers – who are now working at Westrock’s Conway, Arkansas production facility – were actively recruiting current DFA employees to join Westrock, and that they had “secretly obtained confidential and proprietary DFA quality assurance procedures, formulas, pricing information, and food plans,” along with pictures of DFA’s manufacturing lines.

The allegations center primarily on a private joint venture agreement DFA has with an unnamed but “extremely popular” ready-to-drink coffee and energy drink brand, which “on information and belief, Westrock is directly soliciting the joint venture to manufacture the identical products that DFA is currently manufacturing.”

Reached by BevNET, Westrock Coffee Chief Legal Officer Bob McKinney said the company acknowledges the lawsuit but firmly denies the allegations.

“At Westrock Coffee we are, and have always been, committed to conducting our operations with the highest standards of integrity, professionalism, and ethical responsibility,” McKinney said in a statement. “Our company and employees take pride in upholding these values in every aspect of our work, ensuring transparency, honesty, and accountability in all our dealings.”

“We believe that a comprehensive review of the facts will demonstrate not only our compliance with legal standards, but also our unwavering dedication to ethical business conduct,” he added.

As of February, two of the individual defendants – Izdepski and Bethurem – have supplied answers to the complaint denying the accusations made against them, but there’s been no other major developments in the case since then.

While the company denies any anticompetitive behavior, Westrock has been open in recent years about its ambitions to become a major international coffee competitor.

Westrock opened the 524,000 sq. ft. Conway, Ark. facility that is at the center of the lawsuit last year and the company suggested at the time that it would be the “largest roasting-to-RTD operation of its kind.”

Hiring top industry talent to support its growth plans has been part of its stated strategy, as the company told BevNET last year.

DFA declined to comment on pending litigation.

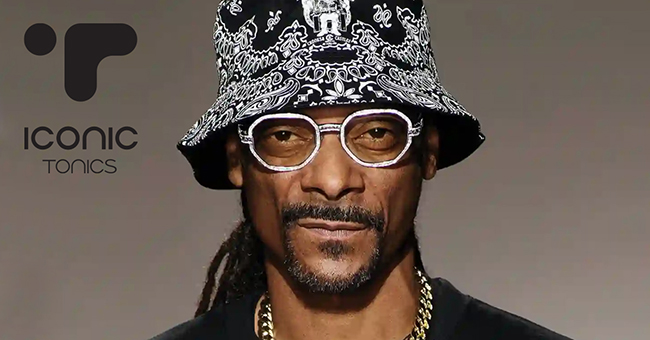

Snoop Dogg, Harmony Craft Bevs Partner on Functional Drink Co

Snoop Dogg’s beverage empire is expanding. The legendary rapper and entrepreneur announced a strategic investment and partnership with Harmony Craft Beverages in March that brings along both his existing range of THC-infused beverages – Death Row Records Do It Fluid and Dogg Lbs Doggy Spritz – and his considerable cultural cache.

The deal creates a new company, Iconic Tonics, that folds in both Snoop’s brands launched in December 2023: the carbonated four-SKU line Do It Fluid in 12 oz. cans, and Dogg Lbs Doggy Spritz. Those will be integrated into Harmony’s existing functional portfolio, which includes Klaus, Malus, Love Yer Brain, and Lift.

“We’ve known [Snoop and his team] for a long time, and really this gives a much broader, and I would say, deeper exposure for Snoop in the functional beverage space,” said Evan Eneman, Co-founder and CEO of Iconic Tonics.

“I’ve always been about innovation, and functional beverages are the next frontier,” said Snoop Dogg in a press statement. “People want drinks that do more than just taste good – they want benefits, and they want choices. Harmony Craft Beverages has been pioneering this movement, and together now as Iconic Tonics, we’re bringing something fresh to the table. This is more than a brand – it’s a lifestyle.”

Beyond his personal expertise in all things cannabis, Snoop’s arrival brings “more mainstream viability” to the emerging THC drinks category, said Eneman. Harmony’s portfolio reflects that approach: partners like acclaimed mixologist Warren Bobrow (with Klaus) and Wayne Coyne of The Flaming Lips (Love Yer Brain) have unique reach with different audiences and use occasions, all under the auspices of functionality.

“Snoop is really endemic in culture. Wayne is deeply endemic in creativity and art. And so these are people that represent I would say more movements and cultural shifts,” said Eneman. “Them together, plus someone like Warren, it just brings a lot of these, you know, endemic understanding and global influence together.”

Snoop’s prowess as a businessman and marketer can come at a cost; some recent CPG ventures, including an RTD coffee and an ambitious cereal brand now in litigation, fizzled quickly, while his other successful projects (Gin and Juice, Still G.I.N.) put more demands on his time. Eneman described Snoop’s participation as a “50-50 partner” in Iconic Tonics, working across the full portfolio, and noted the rapper “will be active in the ways that he can incorporate [the brand] into what he’s doing going forward.

The products themselves are available mainly both online (DoorDash) and in stores like Total Wine & More and Woodman’s Markets.

“We want to reach consumers in a way that they’re used to, having optionality based on occasion or day part or experience they’re looking for. That’s how we’ve built our brands. That’s how we built our experiences,” said Eneman. “And it’s early for us, but we’re seeing that bearing out in the ways that consumers are reacting.”

Jones Soda Enlists New Leadership to Fuel Innovation, C-Store Distro Push

For the second time in less than two years, Jones Soda is looking to new leadership to get itself back on track. Following CEO and President David Knight’s abrupt exit in October, Scott Harvey and Brian Meadows stepped in as CEO and CFO, respectively, with designs to “transform Jones from a craft soda company into a full-fledged beverage company.”

Harvey’s experience is mainly in hospitality and restaurants, with a 40-year career that included stops at Golden Krust Caribbean Bakery, Black Rifle Coffee and most recently as president of coffee chain Dunn Brothers. He takes over from interim president/CEO/CFO Paul Norman, who remains Jones’ Chairman of the Board.

Meanwhile, Meadows, who steps in as permanent CFO from two consecutive interim appointments, has a track record in CPG, highlighted by his most recent role as CFO at Simply Better Brands.

In a press release, Jones stated the new hires will guide strategy around three key areas: modern soda (represented by prebiotic Pop Jones and “Latin-inspired” Fiesta Jones), adult beverage (Spiked Jones and THC-infused Mary Jones) and craft soda, where packaging plays like 7.5 oz. Jones Minis complement the core 12 oz. glass line. It’s part of a broad, multi-year strategy to reverse negative financial trends, targeting higher margin beverage categories to drive bottom-line improvements.

“In the last three months we have adjusted our business plan to prioritize what we believe to be the most promising segments of our portfolio, including new products in our innovation pipeline. We are confident that we now have all the pieces in place to deliver high growth and profitable performance,” said Norman.

“Both Scott and Brian have deep food and beverage experience, have successfully driven business transformation in their previous roles, and we believe will provide immediate hands-on value in implementing our strategy.”

The leadership shakeup coincides with Jones making a serious play for the convenience channel for the first time in its three-decade history. The Seattle-based brand is mounting a new strategic growth initiative this winter that has led it to already secure a presence in roughly 2,000 c-stores nationwide.

The push includes new distribution for its classic 12 oz. glass bottle sodas, Pop Jones in 12 oz. slim cans, and Fiesta Jones line in 16 oz. aluminum bottles, a product developed specifically for the convenience channel. The c-store expansion includes six Circle K divisions – primarily in the Southeast as well as the Grand Canyon and Great Lakes regions – and DK Convenience Stores along with “other national and regional chains,” the company reported.

“C-stores account for nearly half of all single-serve retail beverage sales, so establishing a strong footprint in the convenience channel promises to be a major contributor to our growth over the next few years,” said Norman in a press release. “These new agreements give us a solid foothold that we can leverage to continue expanding into this critical market as we execute our new five-year strategic growth plan.

Slate Says Co-Packer Stole Secrets to Launch Rival Brand Nurri

Whether or not you caught the release of Nurri in October, Slate sure did.

The Boston-based high-protein chocolate milk and iced coffee startup is suing its co-packer, Horseshoe Beverage Co., for allegedly stealing Slate’s trade secrets to develop their own rival product for launch partner Costco.

Slate was already working with Horseshoe in January 2024 when the milk brand contracted with the co-manufacturer to produce shakes with 30 grams of protein (above the usual 20 grams) for an unnamed major club retailer. Horseshoe instead intentionally slowed and botched manufacturing for Slate products, according to a complaint filed by Slate in the U.S. District Court for the Eastern District of Wisconsin.

At one point in the production process, the complaint states, Horseshoe produced samples that were wildly inconsistent across a single batch; despite Slate reformulating, a second run of samples yielded similar results. When Slate moved to a different manufacturer, the issues ceased.

Horseshoe’s alleged motivation, the documents contend, was to share Slate’s trade secrets with sister company Trilliant Food and Nutrition, owners of Victor Allen’s and a major private label supplier for clients like 7-Eleven. Horseshoe used that information – including formulas, supplier relationships, and even the actual idea for the product – to create its own canned ultra-filtered milk product with 30 grams of protein, called Nurri, which debuted exclusively with Costco, according to Slate’s complaint.

The co-packer also is accused of manufacturing defective products (damaged cans) for Slate that made it onto shelves; it allegedly disposed of 35% of a July 2024 production run for that reason.

Horseshoe and Trilliant have both denied the charges, countering that the concept for Nurri was born as a direct request from Costco.

“While other protein drinks are often positioned around nutrition and muscle building, Nurri is positioned as more of a lifestyle brand,” a spokesperson for Nurri told BevNET last year. “Our brand is playful and bright, and we want everyone to enjoy a drink that makes it easier for consumers to get their protein intake up.”

The case remains in discovery.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe