Brewscape: The Latest Craft Beer Brand News

Tilray Acquires 4 Craft Brands From Molson Coors

Tilray Brands struck “a definitive agreement” with Molson Coors Beverage Company in early August for four craft beer brands in its Tenth & Blake division.

As part of the transaction, Tilray added:

• Hop Valley Brewing Company in Eugene, Oregon;

• Terrapin Beer Co. in Athens, Georgia;

• Revolver Brewing in Granbury, Texas;

• And Atwater Brewery in Detroit, Michigan.

Financial details were not disclosed. The transaction closed in late August.

Just over a year ago, Tilray acquired eight brands from Anheuser-Busch InBev (A-B): Shock Top, Breckenridge Brewery, Blue Point, Red Hook, Widmer Brothers, 10 Barrel, Square Mile Cider and Hi-Ball Energy. The deal marked a significant culling of A-B’s craft portfolio and vaulted Tilray into the No. 6 spot among top U.S. craft brewers by volume, according to the Brewers Association (BA).

Tilray Brands chairman and CEO Irwin D. Simon said the deal gives his brewery platform an additional six brewhouses, taking its total to 20 breweries across the country, with production of more than 1 million barrels of beer – 15 million case equivalents – annually.

This would land Tilray firmly in the No. 4 spot among BA-defined craft breweries, nudging out Gambrinus (Shiner, Trumer), according to the BA.

Whitney Stevenson Joins JuneShine as President and Chief Commercial Officer

Whitney Stevenson has joined JuneShine as president and chief commercial officer. She announced the news on LinkedIn, posting a photo of herself with JuneShine co-founders Greg Serraro and Forrest Dein, and writing: “Could not be more excited to join Greg, Forrest and the JuneShine Team! So many exciting things to come!”

Stevenson spent nearly 15 years at Boston Beer, mostly recently serving as senior division director, overseeing the company’s geographic sales team and off-premise national account teams for California, Oregon, Washington, Alaska, Hawaii, Nevada, Idaho, Arizona and New Mexico, according to her LinkedIn page. She also spent more than two years at MillerCoors as an on-premise manager, and four years at Pepsi Bottling Group as a key account manager.

Stevenson’s hiring comes as JuneShine transitions into a total beverage company, drawing inspiration from Stevenson’s former employer, with the goal of becoming “the Boston Beer of the Southwest,” Dein told Brewbound earlier this year.

“We don’t just want to chase trends, we want to build value over a long period of time,” Dein said.

JuneShine started as a hard kombucha company, but has since expanded its portfolio to include spirits-based ready-to-drink cocktails (RTD), as well as light lager brand Easy Rider, which launched in February.

In March, JuneShine announced plans to acquire fellow hard kombucha maker Flying Embers in an all-stock deal. At the time, JuneShine estimated the two companies would account for 63% of all hard kombucha sold in the U.S., with their combined portfolios exceeding 116,000 barrels.

Left Hand Raising Capital to Build Craft Platform

Left Hand Brewing co-founder Eric Wallace has assessed today’s challenging landscape for craft brewers and believes his Longmont, Colorado-based company may have a solution.

“As we look around, we see bad numbers coming out of the [BA], bad numbers coming out of all of the different organizations that track the numbers, and we see the stories of closings and breweries retrenching from distribution and focusing more on the hospitality side,” he told Brewbound.

“As we sit here with a bunch of real estate that we own and control, and a brewery that’s built for speed that can turn out quite a bit of beer – we’ve got great processes, we’ve got a great team here – we should more overtly put a call out to try to consolidate some breweries that are in bad lease situations, or whatever they happen to be in terms of where their pressures are: come over,” Wallace continued.

Left Hand has been under those same pressures, but has been feeling them more acutely. About four and a half years ago, twin problems hit Left Hand almost simultaneously: a sizable cashout for early investors, which depleted the brewery’s savings, and the COVID-19 pandemic, which upended the entire craft beer industry by shutting down the on-premise and canceling live events.

Inspired by the publicly owned non-profit that controls the National Football League’s Green Bay Packers, Left Hand launched an investment round on crowdfunding platform WeFunder.

The campaign hit its first goal, raising $490,481 from 205 investors, who purchased shares of common stock in the company at $36.28 per share.

One of Left Hand’s next goals for the round is to use $1.1 million of the estimated $2.37 million it hopes to raise to acquire another brewery or build a multi-brand platform.

“Our thought was ‘Let’s let people know, let’s get it out there, let’s raise some cash,’” Wallace said. “That’ll give us the flexibility to help bring somebody else into the fold, and depending on the size of the company, there could be room for a few.”

Left Hand’s brewery is capable of producing 100,000 barrels of beer annually, but the company’s output is “not near that right now,” Wallace said.

“We can bring people in and try to get close to 100,000 barrels and that would be good for anybody that’s participating because at that level, this plant can sing,” he said.

“We can make your beer more efficiently here. You can keep your brand, assuming that it has a reason to be in the market. You can keep your brand in the market and maintain its relevance, and try to leverage some of the other relationships that we’ve got out there, because we’re in 45 states, and let’s see if bringing in a couple of partners puts us on the path to be able to be multi-generational.”

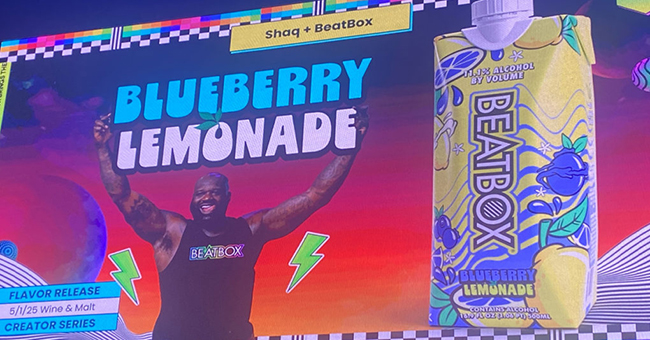

Shaquille O’Neal Invests in BeatBox

Party punch maker BeatBox hosted its first national sales meeting in Houston, which had the feel of a Meow Wolf, with a faux convenience store decked out in neon, a trippy giant mushroom-covered hard tea garden, a Las Vegas-themed area with casino games, a lab for new innovations with “scientists” that looked strikingly like Rick of Rick and Morty Adult Swim fame and the usual presentations about the coming year.

Keynote speaker Jesse Cole, the yellow-tuxedo clad owner of the Savannah Bananas barnstorming baseball exhibition team, who preached an entertainment and fan-first approach to business. BeatBox founders Aimy Steadman, Justin Fenchel and Brad Schultz took the message to heart.

The meeting had a high-energy, upbeat tone as BeatBox is averaging triple-digit sales growth in 2024 and is the No. 1 ready-to-drink single in U.S. convenience stores tracked by NIQ over the latest 13-week period (ending June 13) when the brand’s wine- and malt-based single-serve businesses are combined.

Phil Jamison, BeatBox EVP of sales, added that BeatBox’s depletions have reached 4.2 million through the end of July, and are expected to reach 8.5 million by the end of the year, pushing BeatBox’s wholesaler network revenue to $287 million this year.

BeatBox’s big bet for 2025 is both a product and a partnership. The company announced a deal with sports megastar Shaquille O’Neal, who will invest in the business and also be the face of a new Blueberry Lemonade flavor (11.1% ABV) launching in May.

The partnership with O’Neal, a prolific former athlete, television personality and businessman, will see the Inside the NBA star earn royalties on the sales from the new flavor, which will be reinvested for equity in the business, BeatBox SVP of marketing Zech Francis told Brewbound.

Francis said the initial idea was to partner with O’Neal’s alter ego, DJ Diesel, who not only plays but headlines many of the music festivals BeatBox sponsors.

In a pre-recorded video, O’Neal expressed his excitement in partnering with and investing in BeatBox.

“I’m all about big flavor, and BeatBox delivers that with every sip,” he said. “I’m excited to partner with each and every one of you in the room today. Your support is going to be crucial making BeatBox the biggest alcohol brand in [the] U.S. in 2025. Let’s make it happen.”

The video wrapped to cheers and applause.

“Shaquille is gonna be a massive, massive driver and the face of the Blueberry Lemonade product that we’re coming out with,” Francis said. “But on top of that, he’s investing in our business, like you guys heard. He’s gonna be across the entire portfolio, really promoting the BeatBox business as a whole.”

The spring launch of Blueberry Lemonade will be joined by Watermelon Lemonade, in singles.

BeatBox will also launch a Lemonade variety pack, with both wine and malt bases, featuring Blueberry Lemonade along with Lemon Squeeze and Watermelon Lemonade. Citing Numerator survey data, Francis said 50% of RTD shoppers are interested in a BeatBox Blueberry Lemonade flavor.

Blueberry Lemonade will also be the “hero flavor” of BeatBox’s returning 3L “big box.” Top-selling flavors Blue Razzberry and Fruit Punch will also be in the 3L package.

Sierra Nevada: Company Has ‘A Duty’ to ‘Advocate for Beer’

Sierra Nevada CEO Pryce Greenow began his remarks to the brewery’s wholesalers in August acknowledging that craft beer is not short on challenges, including a “cash-constrained consumer,” category price increases, trends in moderation and bev-alc abstinence “becoming more meaningful,” and “a whole host of substitute products” entering the market.

However, Sierra Nevada believes it has “a duty” to advocate for craft beer and believes the segment can return to growth, Greenow said.

Sierra Nevada hosted wholesaler partners at the company’s taproom in Mills River, North Carolina. The event, along with the company’s sales meeting in Chico, California, was one of Greenow’s first opportunities to speak in front of Sierra Nevada’s partners since becoming CEO earlier this year.

“I have a duty to the [brewery’s founding] family to really write the next chapters, which can be even more successful, more glorious, than the past of Sierra Nevada, which is an incredibly rich history,” Greenow said.

Along with Greenow, Sierra Nevada has made several other leadership changes recently, including promoting Ellie Preslar to CCO. Additionally, the company hired a new chief operations officer this month, leadership teased at the event.

Greenow, who comes from the spirits industry, warned that it’s “always dangerous” to look only at “category averages” when making business decisions, pointing instead to Sierra Nevada’s recent performance trends.

Top 10 craft collectively recorded a -0.6% decline in dollar sales in NIQ-tracked off-premise channels year-to-date (ending July 20) and -1.3% decline in the last four weeks. Meanwhile, Sierra Nevada dollar sales increased +3.1% YTD and +5.1% in the last four weeks.

“Sierra Nevada has a duty to do, as I have a duty to the family, to advocate for craft,” Greenow said. “And there are not many brands at the moment who are leading with craft beer at the lead of their portfolio, at the scale that we can do at Sierra Nevada.

“We believe, confidently, there are exciting times ahead,” he continued. “There are a couple of years that may be tough as we go through it, but … this is now the time to invest.”

“We can’t forget that it [craft] is still very meaningful to all of our businesses,” Preslar added in her own remarks. “It’s very meaningful to the consumers and drinkers that we serve despite the challenging environment we find ourselves in today.”

Sierra Nevada leadership repeatedly assured wholesale partners that “beer-flavored beer” will continue to lead the company and its strategy, including its 2025 innovation plans.

“A lot of people are taking their focus away from their brewing backgrounds and making them more beverage-based companies,” chief brewing officer Brian Grossman said in his opening remarks. “We’re not there, yet. We still have a lot of runway to do with beer.”

“We are brewers and making beer will always be at the core of what we do in Sierra Nevada,” founder Ken Grossman added. “That’s not to say we won’t innovate, because we have a lot of projects and plans to innovate, but beer will always be the core of our business.”

Anderson Valley Brewing Company Listed for Sale at $7.9 Million

Anderson Valley Brewing Company (AVBC) could change hands again for the second time in nearly five years, according to a BizQuest listing that offers the Boonville, California-based craft brewery for sale.

“We have some ongoing conversations with a few interested parties,”AVBC president and CEO Kevin McGee told Brewbound. “But it’s still very early stage and there’s nothing definitive yet.”

The 36-year-old brewery is listed for sale at $7.9 million, which includes AVBC’s $5.4 million in real estate. Also included in the sale price are $5.4 million in furniture, fixings and equipment and $200,000 in inventory.

The company generates $4.2 million in gross revenue, according to the listing. AVBC’s cash flow and earnings before interest, taxes, depreciation, and amortization (EBITDA) were not disclosed.

McGee’s family acquired the brewery in December 2019 without debt or outside investors as a “long-term, multi-generational” play, he told Brewbound at the time. McGee’s parents and siblings co-invested with him to purchase the company in a cash deal from former owner Trey White.

McGee has been an outspoken advocate for the California craft beer industry. He challenged Reyes Beverage Group subsidiaries Harbor Distributing and Golden Brands in court after the country’s largest beer distributor opposed AVBC’s termination of their relationship. A judge sided with AVBC parent company Mainsheet Capital in June.

When inflationary headwinds bore down on the beer industry in 2022 and some breweries passed cost increases on to consumers, McGee promised that AVBC would not raise prices for six months.

AVBC’s brewhouse includes 100-barrel and 85-barrel kettles and a 9-barrel pilot system, capacity of annual output of 100,000 barrels, according to the listing. The “highly sustainable facility” boasts a solar power capture system that provides 50% of its energy needs and “its own self-contained water use and treatment cycle.”

In addition, AVBC’s 30-acre property includes a “beer park” that contains 10,000 sq. ft. of lawn, an outdoor music stage, an 18-hole disc golf course and “an unknown number of fairy doors hidden in tree trunks,” according to the listing.

AVBC comes with an “engaged and active local team that knows the equipment can stay with the business as needed” and “deep and stable distribution relationships.”

Dollar sales of the AVBC brand family increased +0.2%, to $5.582 million, at off-premise retailers in the 52-week period ending August 10, according to market research firm NIQ. Volume, measured in case sales, declined -1.7%.

The brewery did not report annual production data to the Brewers Association in 2023.

Craft ‘Ohana Shifting Modern Times Production to AleSmith; 57 Jobs to be Cut

Production of Modern Times Beer will shift to AleSmith Brewing in San Diego as part of a new contract brewing relationship with Craft ‘Ohana, the portfolio company that includes Maui Brewing, Modern Times and Kupu Spirits.

Modern Times’ portfolio will be brewed at AleSmith’s San Diego facility in an effort to have a “more streamlined approach and strategy,” Craft ‘Ohana announced in September. The transition will happen over the next 60 days, ending with the closure of Modern Times’ production facility in the San Diego neighborhood Point Loma.

“When we set out to find a brewing partner, two things were non-negotiable – our commitment to quality, and brewing Modern Times where the brand started and is the strongest – San Diego,” Craft ‘Ohana co-founder and CEO Garrett Marrero said in a press release. “AleSmith delivers on both of those for us. We’re excited to work with my good friend [AleSmith owner] Peter [Zien] and his team.”

The closure of Modern Times’ Point Loma facility is expected to result in the elimination of 57 jobs after the 60-day waiting period, Craft ‘Ohana president and COO Scott Metzger told Brewbound.

In addition to producing Modern Times’ beer, Point Loma also housed the brand’s coffee roasting operations, which will move to contract production, Metzger said. The facility’s taproom will close, but Modern Times’ North Park and Encinitas taprooms will remain open.

Modern Times had been making some of Maui’s fruited offerings in Point Loma, but will move production of those beers back to Hawaii, Metzger told Brewbound. Maui’s mainland production is contract brewed at Boulder, Colorado-based Avery Brewing.

AleSmith’s 110,000 sq. ft facility houses an 85-barrel brewhouse, a 20-barrel pilot system and fermentation vessels that hold up to 240 barrels, according to its website. The brewery’s contract production clients include brands from “the vibrant world of ciders, coffee, seltzers, sodas, kombuchas and more.”

Notably, Mikkeller shifted U.S. production to AleSmith in early 2023 after ceasing operations at its facility in San Diego’s Little Italy neighborhood.

Maui Brewing acquired Modern Times in 2022 after a contentious and complicated auction process. With the closing of the deal in October 2022, the two companies formed a new parent company, Craft ‘Ohana.

In a May interview for Brewbound’s A Round With, Metzger told Brewbound that Modern Times’ production is “very labor-intensive” and a “relatively inefficient operation, so our main focus has been working with that team to identify efficiencies anywhere we can.”

Meanwhile, Craft ‘Ohana has been working to expand Maui’s operations in Kihei, Hawaii, as it attempts to keep up with demand, Metzger said.

Before Modern Times went up for auction, the brewery operated eight taprooms in California and Oregon. Four of those closed in February 2022, and one more followed during the merger process. Records logged during Modern Times’ court-mandated receivership revealed that the company was behind on rent for some of its taprooms.

Modern Times’ dollar sales (-24%) and volume (-25.5%) have both declined double-digits year-to-date (YTD) through August 10 in NIQ-tracked off-premise channels. Meanwhile, Maui has recorded reversed trends, with dollar sales increasing +18.9% and volume +25% YTD.

Craft ‘Ohana was the 26th largest craft brewery in the country by volume in 2023, according to the Brewers Association (BA). Combined, Maui and Modern Times produced 104,783 barrels of beer last year, a +3% increase year-over-year. Maui Brewing alone produced 78,515 barrels, and was the No. 6 largest BA-defined craft brewery in the pacific region (California and Hawaii) in 2023.

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe