Import Beer’s Tariff Turmoil: How the Category’s Growth Driver Turned into a Loss Leader

If the beer industry had a dollar for every time someone said “we’re controlling what we can control,” the category would possibly be in the black this year.

That mantra has been reiterated by leaders across the spectrum, from the global giants at Constellation Brands and Molson Coors, to the regional craft folks. It’s all in an attempt to hold onto something of structure as the industry tackles numerous macroeconomic headwinds and their impact on consumers, including inflation, U.S. Immigration and Customs Enforcement (ICE) raids and the most unpredictable of all: tariffs.

The latter is being felt by the entire beer industry, mainly due to Section 232 tariffs on aluminum and steel. President Donald Trump enacted said tariffs during his first term, with several exemptions, which eased the initial impact on most industry members. However, this year Section 232 tariffs have been reevaluated, increased and expanded as part of Trump’s numerous second-term trade policy moves.

In June, the rate of Section 232 tariffs doubled from 25% to 50%, resulting in an immediate rise in aluminum prices, the Brewers Association (BA), a trade group representing small and independent craft brewers, shared at the time.

A few months later, more than 400 previously exempt products were added to the list of included aluminum and steel items under Section 232, including can ends and lids.

The changes had an immediate and severe impact, as aluminum is already “the single largest input costs for most brewers’ packaging operations,” according to the BA. As of August 2025, 75% of total packaged craft beer volume and revenue is sold in aluminum, per the BA.

“This illustrates how these tariffs can lead to tough decisions for small and independent craft brewers – they may need to raise prices or scale back their variety of offerings, particularly in distribution,” BA president and CEO Bart Watson said. “There are already lots of straws on the camel’s back, and these are adding more.”

Rising costs have been compounded by macroeconomic trends on imported beer, which has recorded a starkly different performance in 2025 compared to 2024 – turning one of beer’s few growth segments into another loss contributor.

In 2024, imports were one of only three beer segments to consistently grow, ending the year with both off-premise dollar sales (+3.6%) and volume (+2.1%) in the black, well outpacing total category performance (dollar sales -0.6%, volume -2.6%), according to Circana data (year-to-date [YTD] ending December 29). The segment also passed domestic premium as the largest beer segment by YTD dollar sales last year.

That growth was led by Mexican imports, the largest import subsegment, which ended 2024 up 5.3%, marking an increase of more than 54.22 million gallons (approximately 1.75 million barrels) of beer compared to 2023, according to the Beer Institute (BI), citing data from the Department of Commerce.

Mexican imports accounted for 85% of total import dollar sales in 2024, and have been “beer’s most consistent growth driver,” according to Bump Williams, founder of Bump Williams Consulting. The subsegment contributed 82.5% of total import volume last year, according to the BI.

Hints that the tides were changing started to appear in September 2024, when Mexican import volume declined 0.6% year-over-year (YoY) after months of growth. That decline slowly accelerated through the end of the year, with December volume down 6.7% compared to 2023.

Growth returned for the first two months of 2025. But then in March, Trump enacted a 25% tariff against Mexico, and while enforcement of those levys has fluctuated, imports have yet to recover. In BI’s most recent report, Mexican import volume was down 2.6% YTD through July.

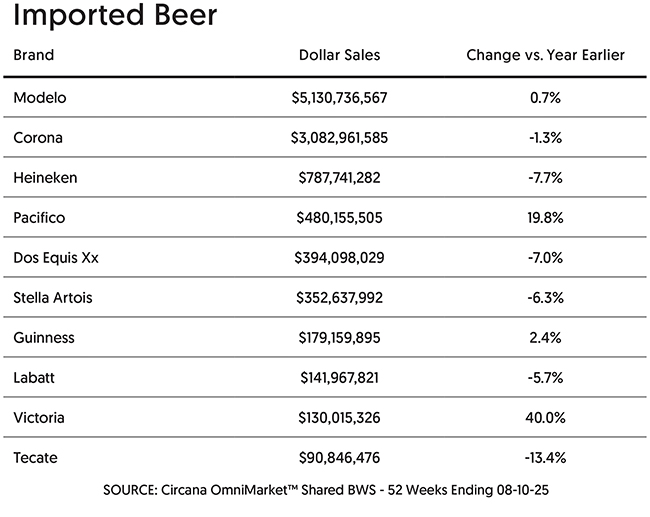

Total import dollar sales (-2.3%) and volume (-4.1%) are now both in decline YTD (Circana off-premise channels, data ending August 10). A year ago, the segment had recorded 4% dollar sales growth and 2.7% volume gains (data ending August 11, 2024).

“I’ll state the obvious, but the beer category can ill afford any more setbacks with key sales growth segments like (Mexican) imports and flavored malt beverages,” Williams wrote in a March update.

The Consumer Factor

The decline in imports isn’t simply from tariffs and rising costs. Possibly an even larger contributor has been changes in Hispanic consumers’ purchasing habits.

Hispanic households make up about 15% of total consumer spending, the highest percentage among “non-White ethnic groups,” according to a recent report from market research firm Numerator, citing purchase data and a Verified Voices survey of more than 1,600 consumers. Over the past few years, that percentage has been steadily rising, up from 13.6% in 2020.

However, growth has now stalled, from 3.2% YoY in 2024 to 0.8% YTD. Absolute spending per Hispanic household has also fallen below that of White households for the first time since 2021, according to Numerator.

“Hispanic spending growth is now driven by population gains, not behavior,” Numerator wrote. “In 2024, population growth accounted for just 23% of spending growth. In 2025, it surged to 72%.

The demographic has been disproportionately affected by wallet constraints and immigration policies. The latter – which has included an exponential increase in ICE raids and deportations – has driven many Hispanic consumers to pull back on celebrations and other beer occasions, causing a decline in beer purchasing.

As cited in Numerator’s report, “With population gains now the core driver of Hispanic spending, changes in immigration policy could have an outsized impact on future spending.”

Among surveyed Hispanic consumers, rising prices was the top concern affecting purchasing behavior, cited by 40% of respondents; second was immigration policy (30%), a “notably higher” figure compared to the general U.S. population, Numerator reported. Other concerns included financial security and personal debt (24%), public safety and crime (23%) and health (22%).

Within beverage-alcohol, Hispanic consumers are leading consumption declines, according to a University of Michigan Monitoring the Future survey, cited in a report by financial services firm Bernstein. Approximately 61% of Hispanic consumers aged 35-50 consumed alcohol at least once in a 30-day window in 2024, down from 78% in 2023, according to the report. White and Black consumers in the same age group recorded significantly smaller declines in the same period: from 69% to 68%, and from 60% to 53%, respectively.

Any changes in Hispanic consumer behavior disproportionately impact beer, as the demographic group overindexes in the category, and underindexes in others, such as spirits.

“Against the backdrop of low consumer confidence and a pressured wallet, this consumer is more vulnerable,” Bernstein analyst Nadine Sarwat wrote.

“But the real kicker today is fear of Trump 2.0 immigration policy,” she added. “Fourty-two-percent of Hispanic individuals in the U.S. worry that they or someone close to them could be deported. Illegal/undocumented Hispanic immigrants account for 2.4% of the U.S. population (even bigger share of households), and we conservatively estimated that their reduction in shopping and socializing could be contributing a 300bps drag to industry volume growth.”

No one has felt import’s headwinds quite as acutely as Constellation Brands, whose portfolio includes Mexican import brands Modelo, Corona, Pacifico and Victoria. Hispanic consumers account for 35% of Constellation’s consumer base, increasing to 50% for its top brand, Modelo.

Constellation ended fiscal year 2024 (ending February 2024) with a flat Q4, but plenty to celebrate, including Modelo passing Anheuser-Busch InBev’s Bud Light as the No. 1 beer brand family by dollar sales. The company built on that momentum through fiscal year 2025, ending the year with dollar sales up 5.8% and volume 4.5% – the second largest full-year growth among the top beer vendors in Circana-tracked off-premise channels.

At the start of the 2025 calendar year – and during initial government moves to start new tariff policies – Constellation leadership stayed relatively mum about potential impacts on their brands’ continued growth. But in April, with the company’s FY25 financials release (year-ending February 28, 2025), Constellation lowered its medium-term projections to FY26 net sales growth between -2% and +1%, and FY27 through FY28 net sales growth between +2% and +4%. Previous medium-term projections had the company’s total enterprise up between 6% and 7%.

Q1 FY26 brought “expected” declines (shipments -3.3%, volume -2.6% YoY), and Constellation leadership reiterated “confidence” in its full-year projections during an earnings call in July. However, in September, Constellation lowered its FY26 guidance again.

Now, Constellation is expecting its beer division’s net sales to decline between 4% and 2%, down from flat to +3%. Projected beer operating income was also lowered from growth (flat to +2%) to -9% to -7%, due to “impact from lower volumes, operating deleveraging and additional tariffs.”

Modelo remains the No. 1 beer brand family in off-premise channels, but has recorded several months of YoY declines, with dollar sales (-2.1%) and volume (-4.1%) both down YTD. Corona is also in the red (dollar sales -2.7%, volume -4.6%), while Pacifico (dollar sales +17.4%, volume +14.4%) has appeared to sidestep external impacts – likely due to its younger and more diverse consumer base.

“It’s very tough to predict how the consumer is going to behave,” CEO Bill Newlands said during Barclay’s Consumer Staples Conference in September. “The thing that we’re spending our time on is controlling the controllables. That’s execution, that’s working in the market place and doing the shelf sets … It’s winning distribution. It’s continuing to invest in the category.”

A Booze-Free Growth Plan

Of course, Mexico isn’t the only contributor to beer imports in the U.S. – though annual volume from the country is more than 10x that of its nearest competitor, the Netherlands.

The Dutch have not been immune to imports’ woes, either. As of July, the country’s import volume to the U.S. was down 15.7% YTD, with July 2025 volume down 30.1%, a loss of more than 2.5 million gallons compared to July 2024.

Those declines can be attributed almost entirely to Heineken. The brewer’s beer brand family – the 10th largest in Circana-tracked off-premise channels – is down nearly double-digits YTD in both dollar sales (-9%) and volume (-10%).

However, Heineken has seen positive momentum from its non-alcoholic (NA) extension, Heineken 0.0, which is the 57th largest beer brand YTD (dollar sales +1.4%, volume +14.4%). In the latest weekly report from Circana (data ending September 7), Heineken 0.0 cracked the top 25 beer brand families, with dollar sales increasing 1.9% and volume up 4.8% compared to the same week in 2024.

Heineken 0.0 is the company’s second-largest brand behind Original, and the only brand within Heineken’s top 4 to record growth YTD in NIQ-tracked off-premise channels (dollar sales +1.8%, volume +8.8%), according to data shared by 3 Tier Beverages (ending August 9). Those figures do not include its on-premise and venue sales – a core channel for the brand.

Heineken has committed 10% of all its media spend on Heineken 0.0 campaigns, according to Forbes. Most recently, the company partnered with the movie F1, with the NA offering heavily featured throughout the film and in digital marketing.

Heineken has also used its global partnership with the motorsport Formula 1 to promote Heineken 0.0 and responsible drinking. The company is the title sponsor of three of the league’s Grand Prix. Heineken previously promoted its low-calorie extension Heineken Silver with the partnership, including using the brand as the title sponsor of the inaugural Las Vegas Grand Prix in 2023.

Heineken expanded Heineken 0.0 this spring with Heineken 0.0 Ultimate, a zero carb, zero sugar line extension launched in Massachusetts and New Jersey.

Additional uplifting sentiment can be shared for imports from Ireland, which are up double-digits YTD (+21.8%) and nearly triple-digits YoY in July (+73.8%). That volume growth has been driven by a U.S. resurgence of Diageo’s Guinness – boosted in part by the viral “Split the G” trend (consumers try to split a Guinness glass’s “G” with their first sip and the foam of their fresh pint).

Like Heineken, Guinness has also seen added growth from its NA extension, Guinness 0.0. The offering is Guinness’s third largest brand in NIQ-tracked off-premise channels behind Guinness Stout and Guinness Extra Stout, and has recorded double-digit growth YTD (dollar sales +11.7%, volume +10.3%).

In 2024, Diageo invested $30 million euros (approximately $32.5 million) in Guinness 0.0 production in 2024, helping to support the nearly 50% volume growth the offering recorded globally last year.

Imported NA beer volume is up nearly 20% YTD, to just over 405,000 barrels, according to the BI. July volume was up 2.7% YoY, to nearly 55,000 barrels.

The Netherlands account for more than half of that volume, importing nearly 6.63 million gallons (approximately 213,772 barrels) to the U.S. YTD, a 2.3% increase compared to the first seven months of 2024. Mexico is the second largest importer of NA beer (+74.7%, to more than 3.13 million gallons YTD), followed by Germany (flat, at nearly 1.02 million gallons) and Ireland (+49.7%, to nearly 928,000 gallons).

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe