Stick Shift: How TikTok Jump Started Stick Pack Production

Where were you when the #WaterTok wave hit?

For many, the event probably passed unnoticed. The TikTok phenomenon — in which recipes and hacks for flavoring water, typically through branded drink mixes and syrups, were shared far and wide — became, for a moment back in 2023, the biggest thing on social media (before the next viral video trend took its place). The beverage industry is still feeling its reverberations, as a younger generation of drinkers — consumers raised with a cell phone in one hand and a Stanley tumbler in the other — are sending category suppliers in search of more manufacturing muscle.

When BevNET spoke with Jel-Sert in January 2024, the Chicago-based powder drink powerhouse was still buzzing from #WaterTok. Sensing an opportunity, the company embraced the concept, quickly bringing new flavors to market and splashing a label for “TikTok Trend-Inspired Flavors” across its packaging.

Just over a year later, #WaterTok is “still certainly a piece of our strategic plan going forward,” said Matt Ingemi, VP of strategy at Jel-Sert. The brand’s TikTok-inspired flavors have performed well, he noted, with new SKUs and packs (variety and single-flavor) continuing to come off the lines. But more than a demand for wacky flavors, the trend seems to confirm the underlying strength of the stick format: young consumers’ insatiable thirst for all things at all times plays directly to the strengths of what Ingemi calls “the ultimate delivery system.”

“Everything that we’re doing here from a planning perspective — whether it be facility or infrastructure or people, certainly has an eye toward the stick (category),” he said.

That’s not hyperbole; Jel-Sert produces upwards of 10,000 sticks per minute across its facilities, running 24 hours per day at least five days per week. That includes a new plant opened at the start of 2025; at another existing manufacturing site, the company is adding equipment and expanding operations “as fast as we can,” in the words of Jel-Sert president Ken Wegner. Against that backdrop, Jel-Sert’s near-century of expertise in the powder business has taken on new shine, with the company touting “complete turnkey solutions” for large CPGs eyeing the category.

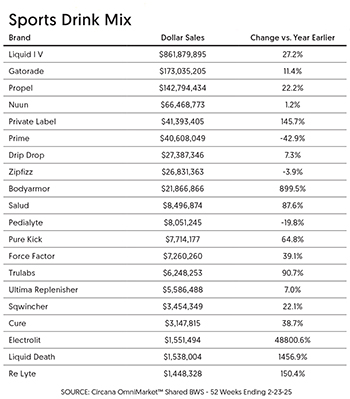

But in the end, Wegner noted, it’s really about making more. Amidst a sports drink/hydration mix category growing at 20.8% year-over-year through March 21, private label is up 145%.

“We’re very selective about who we make private label products for,” he said. “There are a lot of people that want to get into the powder space where the volumes are just not there. They’re small and that’s not necessarily our fit.”

Jel-Sert isn’t the only brand riding the #WaterTok wave: last October, Dyla Brands, maker of Stur water enhancers, opened a new 10,000 sq. ft. “Flavor Lab” in Edison, New Jersey, capable of producing “several thousand bottles” of liquid and powder drink mixes a day. Like Jel-Sert, Dyla has used the TikTok trend to both create highly limited and targeted SKUs that can serve as billboards for its services.

Thanks to automation, the New Jersey manufacturing site, operating with just two full-time employees, can produce stick packs for around 30%-40% less than many competitors, said founder and CEO Neel Premkumar, while also providing warehousing capacity for 90,000 2 oz. bottles of Stur liquid water enhancer.

And while Jel-Sert is the larger company, Dyla’s outlook is similarly attuned to scale. As #WaterTok recedes from its peak popularity, Dyla has secured production contracts for liquid enhancers from C4, Ocean Spray, Dole and others, providing the company better terms with which to negotiate with retailers.

“As more and more players have gotten into the space… scale actually becomes really critical,” Premkumar said last year.

By the time you read this, even more brands may have jumped in the powder and liquid mix space. Whether through acquisition or otherwise, major strategics own the top end of the category via names like Gatorade (Pepsi), Liquid I.V. (Unilever), Nuun (Nestlé) and Mio (Kraft Heinz), followed by new-ish players like Celsius, Alani Nu and PRIME. But the market dynamic allows for ambitious upstarts to also find space: while Electrolit sales soar in RTD, its presence in powders hasn’t pushed out indies like Cure, DripDrop and and Tru. Slickly marketed products from design-driven brands like Liquid Death, Waterboy and “hydration cube” maker Waterdrop have broadened appeal even further.

From a functional perspective, the fragmenting of the category beyond just hydration is giving smaller players an opportunity to “own” a defensible, if narrow, proposition. Take The Absorption Company, a startup launched last year in trendy L.A. grocery Erehwon touting its superior nutrient bioavailability. The concept aligns with health and wellness trends, but offers a distinct story built around the idea that only 14% of nutrients consumed orally are absorbed. That’s given founders Zeke Bronfman and Nate Medow the foundation what they envision as a platform brand – but also provides the justification to charge a premium: single-serve powder sticks sell in 14-count ($40) or 28-count ($70) boxes in Restore, Sleep, Energy and Calm SKUs.

That focus works for a startup, but for a large-scale and well-resourced supplier, the biggest challenge for Jel-Sert is where to innovate next. The #WaterTok experience has informed its consumer-centric approach, now playing out through releases like Pure Kick Pro (a more “upscale” version of its flagship hydration powder), its Margaritavilla-branded non-alcoholic mocktails and a forthcoming licensed collaboration with juice bar chain Jamba Juice, both of which nudge Jel-Sert towards a more premium positioning.

“Our heads are always spinning around,” said Wegner. “We’re always looking at what’s going on in the marketplace. What are competitors doing? What are we missing? And I think retailers are starting to wake up.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe