On the back of a successful first half of 2022, global ingredient supplier SunOpta is poised to expand its already large footprint of branded, private label and co-manufactured food and beverages throughout North America through strategic volume growth and product innovation.

“It’s a problem-solving culture,” CEO Joe Ennen told BevNET on Monday. “On the sleeve of all of our corporate t-shirts is G.S.D. which stands for Get Stuff Done, or a different ‘S’ if you’re so inclined.”

As one of the largest plant-based dairy manufacturers, SunOpta is projecting demand for oat, almond, soy and other plant-based milks to continue growing. It’s been a 30-year migration from traditional cow-dairy to plant-based and there is no plateau in sight, Ennen said.

During its earnings call last week, the company reported that plant-based revenues were up 31% at $146 million in the second quarter which represented the 15th consecutive quarter of revenue growth.

The company is preparing to open its new Midlothian, Texas plant by the end of the year which will boost production capabilities to meet the growing consumer demand for popular products like oat milk and plant protein-based RTDs. According to SunOpta, the new facility will complete a diamond-shaped distribution network between its current manufacturing plants in California, Minnesota and Pennsylvania that will reduce 15 million freight miles annually, and 59 million less pounds of carbon emissions.

Sustainability Key To Growth Strategy

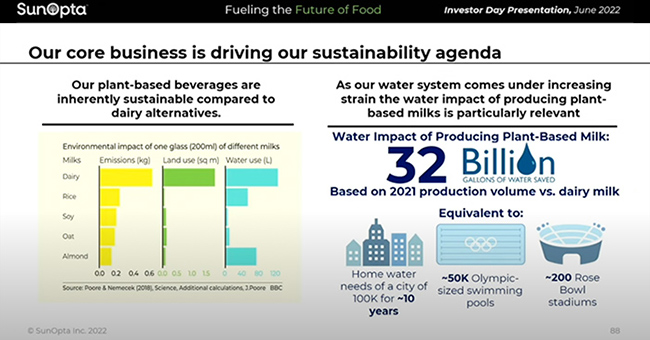

Sustainability continues to guide how the company optimizes its growth strategy, Ennen said, because consumer demand for plant-based dairy is driven in part by environmental and animal welfare benefits.

Under that umbrella, packaging is a primary focus. In the company’s 2021 ESG report, SunOpta announced that 97.7% of all packaging by weight is recyclable with a goal of reaching 99% recyclable, compostable or reusable packaging by 2025. The company claims to have reached zero-waste at three facilities in Minnesota and Pennsylvania, and also reported that it is working on making its smoothie, acai and chia seed bowls in residentially-compostable packages.

The company said that it is one of the sole North American companies that utilizes a half-gallon Tetra Pak carton for its plant-based milks in foodservice.

“Big coffee shops go through a lot of plant-based milks in a day. They might go through 8,10, 12,14 or 20 (32-ounce) packages in a day,” Ennen said. “Instead of opening two-32 ounce cartons of almond milk, the barista only has to open one carton and it uses 40% less packaging.”

Brands, Business Diversifies

SunOpta is mainly a private label co-manufacturer but it has made strides with its own branded products as well.

The company has rebranded Westsoy as WestLife with a new 16g protein Smoothie Blend product as well as reimagining the Dream brand with organic “whole” and “2% fat” ricemilk SKUs.

During Sunopta’s Investor Day event in May, company leadership honed in on the opportunity in RTD protein beverages. According to SunOpta research, 40% of protein powder is plant-based whereas only 3% is RTD. This leaves ample white-space for the company to fill with the increased production from the Midlothian facility.

SunOpta will focus on both whey and plant-based protein drinks initially; production lines for the latter “are incredibly expensive” and require substantial volume, Ennen said, but the company is working on developing its capabilities in branded, private label and co-manufactured products.

On the production side, the company is diversifying its geographic sources of supply as well as the raw ingredient supplier companies themselves to hedge against the more frequent fluctuations of the raw ingredient commodity markets.

“At the end of the day, (diversification) is the only lever that you have to pull when you’re talking about things like how do you manage around increasingly frequent weather events,” he said.

Ennen feels confident that sourcing will be able to keep up with production levels. Even when there are shifts in commodity prices, the company has the ability to pivot to new suppliers quickly due to its strategic position in the agricultural sector.

“Culture” Helps Cure Challenges

Even though SunOpta has had record breaking sales in the first half of 2022, the end of FY2021 posed production challenges that have informed the company’s approach.

“The snapback that we had in Q1 and Q2 was nothing short of impressive,” Ennen said. “I’d love to point to some magical program that we implemented… But honestly, it’s just the culture that we have. We have figured out how to run our plants with higher degrees of turnover than what we would have seen historically.”

The food and beverage maker is still keeping a close eye on labor issues as a possible roadblock to its continued success, especially as its staffs the new Texas plant. A plant manager has been in place since the end of 2021 and most managerial roles have been assigned as it prepares to hit full-scale operation in the first quarter of 2023. The new facility is geographically well-situated to offer a robust labor source as Texas continues to draw a larger population in recent years.

“There’s labor challenges everywhere. We don’t have a single place where we operate a manufacturing plant where it’s easy. No place is easy,” Ennen said.