After several years focused primarily on innovating in the food space, Swedish plant-based products maker Oatly is getting back to basics with two new oat milk launches: Unsweetened Oatmilk and Super Basic Oatmilk.

Initially announced during the company’s Q3 earnings last year and launching nationwide this month, Unsweetened and Super Basic add better-for-you options to the brand’s flagship oat milk line. Unsweetened contains zero grams of sugar and 40 calories per serving, while Super Basic – true to its name – simplifies the ingredient panel by removing all oils and emulsifiers, containing only water, oats, sea salt and citrus fiber.

Each SKU is available in 64 oz. cartons and will retail in line with the rest of Oatly’s plant milk portfolio, priced around $5.99.

According to Mike Messersmith, president, North America at Oatly, the company had been limited in its ability to innovate within the oat milk space by its myriad supply chain and manufacturing hurdles. With the brand now confident in its ability to produce and deliver beverages throughout the U.S., Oatly is once again focusing on innovating in its flagship category.

“They [the new oat milks] both represent abilities for us to go deeper with existing customers, and also expand our overall distribution footprint and bring more delicious plant-based oat milk products to more people,” Messersmith said.

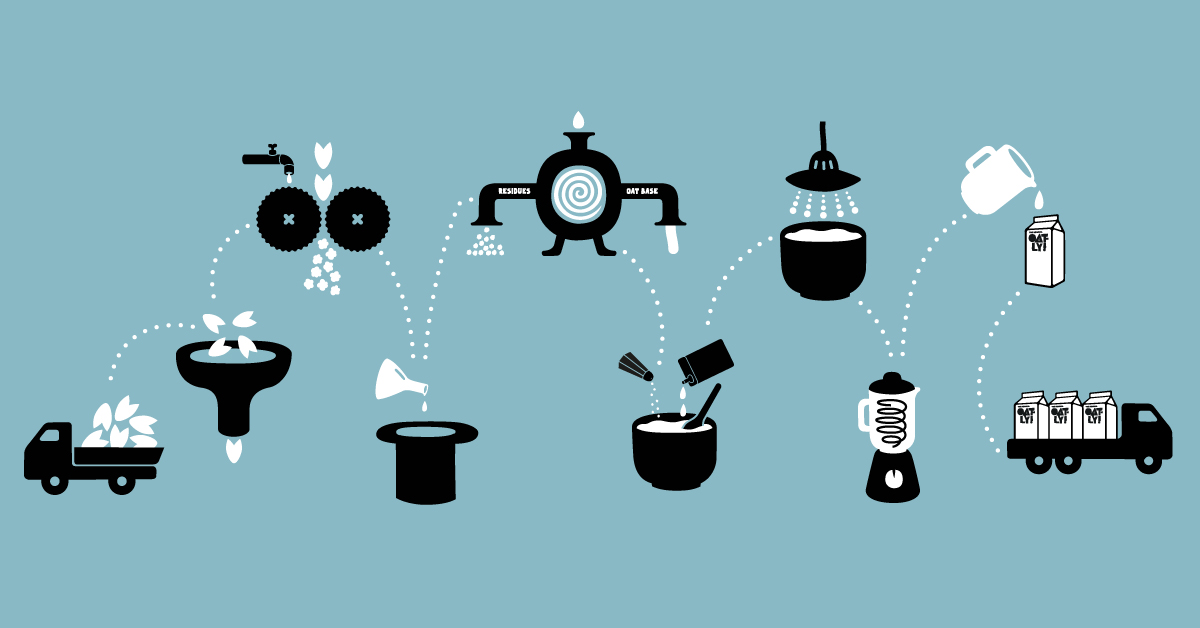

Both innovations were responses to consumer feedback, he said. While the brand has received some media criticism in the past over the sugar and oil content of its plant milks, the Unsweetened and Super Basic varieties are a reaction to requests from its existing customers. In the case of Super Basic, Messersmith said the company saw a number of videos on social media of consumers making their own homemade oat milk and recognized an opportunity to produce a more convenient alternative.

“I’ve had friends that showed me their own homemade oat milk, made with cheesecloth and a sieve, and I’m just like, ‘We can do that better for you! It will be easier and taste better,’” he said.

Messersmith said the launch was timed for January in order to be ready for retailer resets, adding that the company’s commercial team made a “concerted effort” to ensure the innovations are available in as many chains as possible at launch. The drinks are currently rolling out now nationwide in retailers including Albertsons, Publix, Sprouts and Target stores.

Additionally, Messersmith said Super Basic will be available in Whole Foods, Meijer and Shop Rite accounts and Unsweetened will add Kroger, Stop and Shop and H-E-B stores among others.

Returning to Innovation

When Oatly first launched in the U.S. around 2017, the broader plant-based milk category had been experiencing significant growth and innovation, but oat milk – at least as a competitive subcategory – was more or less nonexistent.

Since then, the oat milk set has become one of the major drivers of growth for dairy alternatives; for the 52-weeks ending October 8, 2023, market data firm Circana reported refrigerated oat milk sales rose 12.3% to over $557.9 million in MULO and convenience retail. Oatly ranked as the number two brand in the set (behind only HP Hood’s Planet Oat) growing 13.3% to $126.4 million in that period, reflecting a 22.6% dollar share.

In May, Oatly named global president Jean-Christophe Flatin as CEO, assuming the role from Toni Petersson, who had held the chief executive title since 2012. In its Q3 earnings report, Oatly reported that distribution in the Americas rose 18% year-over-year to 39% ACV. Although foodservice revenue fell 6% in the quarter, the report showed largely positive signs for the brand’s U.S. business, even as global revenue for 2023 was projected to come in at the “low end” of a projected 7% to 12% growth range.

In recent years, Oatly has introduced a number of food products to the U.S., including plant-based cream cheese and an array of frozen desserts featuring scoopable pints, dipped bars, mini cups and liquid soft serve mix.

While food has performed well for the company, Messersmith called those products a “down payment for the future,” noting that the brand’s oat milks are still far and away its “top performing velocity items.”

“You have a lower penetration of consumers going into those segments looking for plant-based options; even [among] consumers that are buying plant-based milks for their family, we’re still seeing an early stage adoption of other segments,” he said.

“We’ve learned a lot about the food, we love our offerings there, we think that there’s stuff that we can build on and grow as time goes on,” he added. “But I think when you’re building the business that we want to have, they can’t come at the expense of your core, which for us is the oat milk – it’s the thing we do best, it’s the thing we did first.”

Not all of Oatly’s food innovations have stuck; after introducing its “Oatgurt” plant-based yogurts in 2020, the line was put on pause last year. In a statement, Oatly senior director of communications Mary-Kate Smitherman confirmed the Oatgurts are no longer being sold in the U.S. and the company is instead “focused right now on expanding our portfolio to increase consumer choice and usage of our fluid products.”

Looking ahead, Messersmith said Oatly still sees a long runway of innovation opportunities with its oat milk portfolio. One area the company is interested in expanding is pack size, which can help the brand to be more competitive in different retail channels, as well as opportunities around flavor. Meanwhile, in Europe, Oatly offers an even larger range of beverages, including canned lattes, drinkable “Oatgurts,” kids single-serve cartons, and more.

“It doesn’t have to just evolve into slight flavor variations or slight calorie variations where you’re just adding diminishing returns to the shelf, that isn’t our goal,” Messersmith said. “We want to have a simple powerhouse portfolio that’s really able to perform.”