Just in time for Dry January, boutique non-alcoholic beverage retailer Sèchey and Target are expanding their partnership to curate an NA cocktail and wine set in stores this month, after a pilot run that began in December.

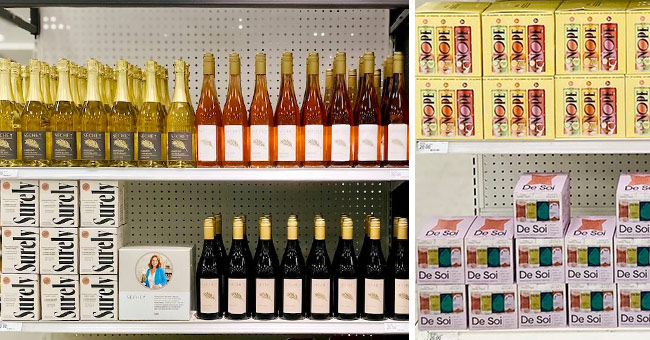

Sèchey founder and chief curator Emily Heintz announced the deal last month, which involved her company developing endcap assortments of non-alc brands for 450 Target stores. The initial set features five emerging brands, including canned cocktails De Soi, Ghia, Kin Euphorics and NOPE Beverages, and NA wine brand Surely, as well as Sèchey’s own branded dealcoholized wine.

Founded in 2021, Sèchey operates a brick-and-mortar store in Charleston, South Carolina while also selling nationwide through its ecommerce site. The company also opened a temporary pop-up location in New York last year.

“This is a dream come true,” Heintz said. “The fastest way for us to increase the awareness of NA products is to bring them to local neighborhoods. People shop at Target, it’s already a destination, we’re just creating new incremental behavior.”

Calling the set “Sèchey for Targèt,“ Heintz said the selected brands are among the best-selling brands that her store sells. The Target sets all feature variety multi-packs in custom boxes in order to drive trial and “create new shopping behavior,” she said.

“[Target has] been focusing on their grocery assortment and how they can elevate grocery the way that they elevated apparel back in the early 2000s,” Heintz said. “So with my background in luxury apparel, that was my pitch to them; Because non-alcoholic beverages tend to be at a higher price point, let’s curate something where it’s the best of the category.”

The brands also hit different tastes and preferences, Heintz noted. For example, NOPE is a party-minded “alt-tail” that plays on classic cocktail recipes like margaritas and mojitos, while Ghia represents a more bitter, aperitif styled drink. Kin Euphorics and De Soi, which are made with adaptogens and botanicals, provide functional options.

The partnership comes as the low- and no-alcohol categories have seen significant growth and more consumers claim they are drinking less. Alcohol delivery platform Drizly reported that sales of low- and no- products rose 62% year-over-year in 2023 and NielsenIQ found NA sales in the 52-weeks ending August 23, 2023 were up by $121.2 million year-over-year, to around $510 million.

Heintz said non-alcoholic beer brand Athletic Brewing Company will also be featured in Target stores next to the Sèchey sets, however Athletic is not a part of the curated assortment.

For Sèchey, the partnership also provides a valuable opportunity to grow awareness of its own brand. Reflecting on 2023, Heintz said it was a challenging year for Sèchey when it came to the “macro-economics” of the business, pointing to the investment environment as the company works to raise a Series A funding round. However, Sèchey has continued to see its business grow as word of mouth has been a primary driver for new consumer acquisition.

Looking ahead to 2024, Heintz said the business will look to scale back the number of brands it offers in its store and on its website. Pointing to the “explosion of brands” entering the NA alternatives category, she said curation will play an important role in Sèchey’s strategy going forward as the business focuses on “highlighting the best.”

As well, Heintz wants to expand Sèchey’s private label beverage offerings and its wholesale business. She also wants to begin introducing ancillary products such as branded barware and accessories, aimed at further growing Sèchey’s brick-and-mortar business into destination bottle shop.

“We do want to have Sèchey branded products, and we can do that without conflicting with the brands that we carry, she said. “That’s pretty standard in retail, you have the name brand and we can have the Sèchey [branded bottle] next to it that’s similar.”