The only thing more expansive than the definition of ready-to-drink beverages (RTDs) is who’s drinking them. It seems like RTDs are everywhere, but even the segment’s explosive popularity has its limits. Pinpointing the target audience for a product requires both anticipation of demand as well as flexibility towards evolving trends—a balancing act that the RTD segment has shown it can handle with dexterity through data.

When identifying the consumers most likely to buy a product, producers often look at points like gender, age, geographic location, habitual timing of purchases, and flavor trends. When brands successfully maneuver through these data points, sales increase. Statistics provided by GoPuff, which is the parent company to beverage retailer BevMo!, show that over the past two years—and thanks in large part to leveraging specific data points for maximum sales potential—national weekly sales of RTD products have risen by about 12% week over week.

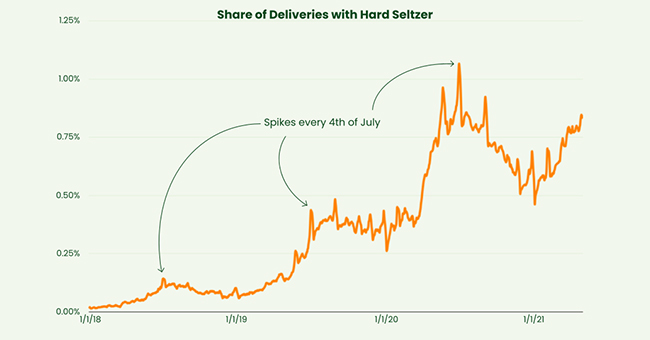

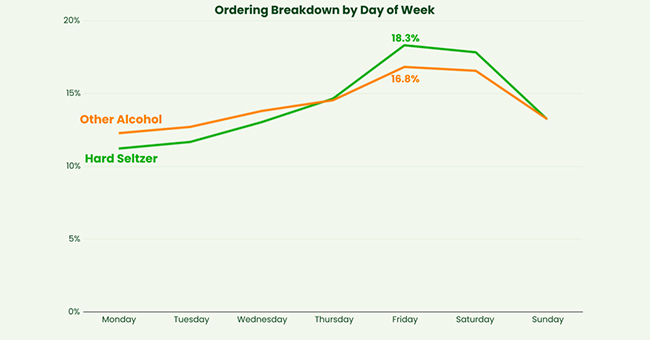

Grocery delivery platform Instacart also analyzes historical data in order to predict the most likely times an RTD sale may occur. Instacart reports that most hard seltzer sales happen on Fridays, followed by Saturdays, which falls in line with other alcohol sales.

Although this time frame revelation proves helpful for overall sales and marketing, it lacks a comprehensive view of the ideal potential purchaser. Painting a picture of the most likely RTD consumer requires a closer look at other data points like age, location, and similar purchasing patterns.

How To Identify New Consumer Opportunities By Age, Gender & Geography

GoPuff uses past purchasing patterns to identify their next best customer, revealing that while BevMo!’s regional RTD buyers in the southwest are fairly evenly split between men and women, nationally, goPuff’s data indicates a slight edge towards women. Additionally, 27-30 year olds remain the top purchasers in this particular segment.

Instacart’s RTD data is similar to goPuff’s, showing that many RTD drinkers—notably, hard seltzer drinkers—tend to skew younger than other alcohol segments: a median age of 38 (customers purchasing RTDs) versus a median age of 43 (customers purchasing other alcohol). When comparing hard seltzer sales to all other types of alcohol sales on Instacart, buyers between the ages of 21 to 43 are the most likely to commit to purchasing, especially those located in smaller metropolitan areas and suburbs, rather than large cities.

Geography’s role in product development is rarely the top factor dictating brand decisions, but in some cases, its importance is undeniable. Bronya Shillo, founder and CEO of Fishers Island Lemonade, says their vodka and whiskey-based RTD lemonade remains a dominant player in the northeast, according to Nielsen data. Thanks to their location-specific offerings, specifically designed to emulate a coastal New England vibe, Shillo claims they’ve outpaced category growth by growing 83% in 2020 and is projected to grow more than +100% in 2021. “For the last two years, Fishers Island Lemonade is the top-selling spirits based spiked lemonade RTD in the Northeast [and] New England,” she says.

This geographic specificity can skew wildly from brand to brand, but can be a helpful tool for brand narratives that rely on a sense of time and place for attracting hyper-local buyers.

How To Identify New Consumer Opportunities From Other Segments

It’s the billion dollar question: what else are RTD consumers drinking, and how can RTD brands convert exploration into loyalty? Online alcohol service Minibar Delivery reveals they’ve seen a 128% increase for new RTD brands sold on their platform for summer 2021 compared to summer 2020 with overall liquor-based RTD sales up 145% year-over-year. Drawing data from their top five selling RTD brands (Cutwater Spirits, Skinnygirl, On The Rocks, 1800, and Two Chicks), they report “61% of products sold are tequila-based, 18% are vodka-based, 6% are rum-based, 4% are gin-based, and 4% are whiskey-based,” with margaritas and palomas making up the most popular products in sales.

But considering a huge swath of the RTD segment is already spirits-based, making the jump from spirits to RTDs is an easy one. When it comes to attracting habitual wine drinkers, however, the evolution of wines in cans rather than bottles has helped improve awareness and accessibility to other RTD products. Nielsen reports that “between 2017 and 2021, volume sales for canned wine in Nielsen-tracked channels increased more than 3,800 percent,” indicating the increasing acceptance of canned vs. bottled wine has serious segment-switching potential.

“Hard seltzer and ready-to-drink cocktails have been on the rise, but wine spritzers are making a comeback and these new, wine-based RTDs are not the wine coolers we remember from the 80s,” says Lindsey Andrews, CEO & cofounder of Minibar Delivery.

BevMo’s California stores, as well as Phoenix and Seattle, have collectively added 65 new RTD products to their lineups between 2019 and 2021. Of these newly added RTDs, the top 20 sellers fell under the categories of: cocktail-inspired, followed by coffee and teas, agua frescas, frozen treats, soda, and traditional malt beverages or “flavored malt beverages” (FMBs).

With these statistics in mind, the chances of acquiring new customers whose segment-specific loyalty is waning is best found in spirits and wine. “[RTDs] offer an easy alternative for non-beer drinkers,” says Andrews. But, as craft beer’s market share continues to decline, opportunities for turning beer drinkers into RTD drinkers may grow.

Predicting The Future RTD Consumer

Ultimately, who is the ideal RTD consumer? While there is no one single portrait for RTD drinkers, based on the data provided, they are likely Millennial women living near metropolitan cities who also drink wine and/or tequila-based mixed drinks and enjoy entertaining. There’s some potential for attracting habitual beer drinkers, but its more male-dominated demographic makes it a slightly harder sell.

But already certain signs may hint at who future consumers will be. “We’ve started to see the beginning of CBD products entering the beverage space and I think we’ll continue to see the evolution of the products into the cocktail space. CBD products are attractive to those looking for a non-alcoholic option [and] it makes sense with the lower ABV products as well,” says Minibar Delivery’s Andrews.

Examining partnership opportunities can help convert potential customers into loyal ones, as well as open brands up to entirely underdiscovered audiences. But at a base level, flexibility and foresight are going to be crucial for survival. “The key is to have options to fit different occasions and flavor preferences,” says Fishers Island Lemonade’s Shillo. A variety of ABVs as well as flavors will give RTD brands the best chance at acquiring and keeping new consumers.

Finally, a schism between hard seltzer as a standalone category from RTDs seems inevitable. “In August 2021, the hard seltzer category was almost double the size of spirit-based RTDs on Drizly, accounting for 4% and 2.5% of overall share respectively,” says Liz Paquette, the director of brand at spirits delivery company Drizly. “However, hard seltzer’s share declined 12% compared to August 2020 while ready-to-drink share grew 85% year over year—as RTDs continue to skyrocket this year, increasing competition with the hard seltzer category.”

Hard seltzers aren’t going anywhere, but their continued existence as an outlier within RTD may lead the category to break away once and for all. If and when that happens, the concurrent data shift may reveal new insights for non-hard seltzer RTDs that point to new directions and even new consumer potential. As this split looms, the lack of existing data may lead some hard seltzer companies to experiment with sales and marketing techniques in order to create a narrower potential customer pool.

For now, successful RTD combinations seem to come from flavor innovation, a range of ABVs, a reliance on spirits as the base spirits, and specifically targeting the most likely consumer (suburban Millennial women). As RTD dominance continues, expansion into CBD as well as low-to-no alcohol offerings will continue to create opportunities for alternative buyers across a multitude of demographics, eventually creating a world where virtually every drinker stands to become an RTD drinker of one kind or another.