NOSHscape: The Latest Food Brand News

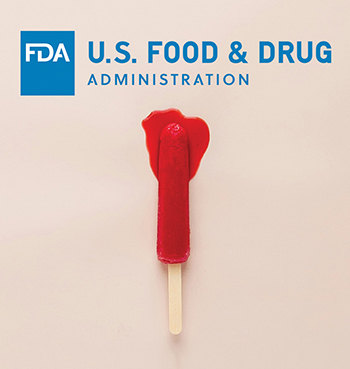

FDA Moves To Ban Red Dye 3

The Food and Drug Administration (FDA) announced in mid-January it has banned the use of Red Dye 3 (Red No. 3) in food and beverage due to its potential to cause cancer.

The FDA has revoked the authorization to use the synthetic dye using a 1958 provision, the Delaney Clause, prohibiting the use of any carcinogenic food additives from the Food, Drug and Cosmetic Act.

Food makers using the synthetic dye have two years to reformulate their products, according to the FDA, and imported food will also need to comply with the directive by that time. Common foods that use the synthetic coloring are candy, cakes and cupcakes, cookies, frozen desserts, and frostings and icings.

The FDA did concede that Red No. 3 is “not as widely used in food and drugs when compared to other certified colors,” but the food coloring has been shown in studies to cause cancer in male rats.

The dye has already been banned almost completely in Europe, Australia and New Zealand.

The news was initially teased in a Biden White House Fact Sheet yesterday, explaining the administration’s food system investments. Similar rumors had surfaced in December during a U.S. Senate health committee meeting. At the time, FDA deputy commissioner for human foods Jim Jones said that a petition calling for a Red Dye 3 ban was being reviewed by the authorization board.

Various industry groups have applauded the decision, with the Environmental Working Group (EWG) calling it a “monumental victory.”

“For years, Red 3 remained in food products, despite growing evidence linking it to health problems, particularly in kids,” said EWG president and co-founder Ken Cook in a statement. “This ban sends a strong message that protecting the health of Americans – especially vulnerable children – must always take priority over the narrow interests of the food industry.”

Food safety advocate and co-founder of Yuka Julie Chapon said the rule was “about time.”

“The FDA’s decision is a step forward, but we must continue to push for stronger regulations – dozens of risky additives are still allowed in the U.S.,” she said.

The National Confectioners Association (NCA) had a more tempered response to the decision, saying that “the conversation around state-level proposals that seek to ban certain FDA-approved food additives has been filled with myths pushed by unqualified voices and lacking facts.”

The trade group’s public statement went on to note that Indiana, Maryland, South Dakota, Washington and West Virginia had all rejected laws that would ban certain food additives because the “proposals lack scientific basis.”

“We are in firm agreement that science-based evaluation of food additives is needed – and we follow and will continue to follow regulatory guidance from the authorities in this space, because consumer safety is our chief responsibility and priority,” said NCA president and CEO John Downs. “Usurping FDA’s authority does nothing but create a state-by-state patchwork of inconsistent state requirements that increase food costs, create confusion around food safety, and erode consumer confidence in our food supply.”

Proper Good, Inc. Brings in Fresh Funding

Ready-to-eat meal purveyor Proper Good, Inc. announced on Jan. 13 that it closed a $3.5 million funding round in the fourth quarter of 2024, backed by internal investors. The capital infusion will help fuel brick-and-mortar growth and increase household penetration.

“We’re absolutely thrilled to have the incredible backing of our investors as we deepen our retail partnerships. This support empowers us to bring an even wider variety of delicious, easy meals to Walmart shelves in 2025,” said Christopher Jane, co-founder and CEO, in a press release.

Launched by Jane and his sister Jennifer in 2020, the Austin, Texas-based company produces a portfolio of simple-ingredient, single-serving meals, ranging from oats to soups to pastas. In 2021, Proper Good secured a $400,000 investment for 20% equity from entrepreneur Mark Cuban during an appearance on “Shark Tank.”

The direct-to-consumer brand expanded into brick-and-mortar retail in 2022 with a rollout to over 2,000 Walmart stores nationwide. Today, Proper Good has 19 items across three categories in 2,500 Walmart stores throughout the U.S., which retail for under $5 each.

To support the Walmart launch, the company closed a $3.5 million seed funding round in 2022 led by YETI Capital and The Artisan Group, with additional participation from Doug Bouton, co-founder of Halo Top and Gatsby Chocolate.

Jane previously told Nosh that for Proper Good to become a household name as a premium shelf-stable brand, it recognized it couldn’t be a DTC-only company. The brand chose to build its position at Walmart instead of pursuing natural and specialty retailers immediately.

“We’re proud to partner with Walmart as our first entry into the brick-and-mortar scene, given that over 90% of the U.S. population lives within 10 miles of a Walmart store,” said Jane in 2022. “However, we’re able to move upstream into more natural, specialty channels in the future since we also offer items made with high protein and low sugar.”

In late 2023, the company raised $5 million from current and new investors, including YETI Capital, to fuel retail growth and marketing.

Proper Good isn’t the only DTC meal company to venture into brick-and-mortar retail in recent years. In 2018, Kroger purchased Home Chef and launched a collection of retail meal solutions. In 2023, Daily Harvest made the jump into store freezers across the country, debuting at over 1,000 Kroger stores nationwide.

Beyond retail expansion, Proper Good’s new funds will be deployed to accelerate product development, expand operations, and enhance consumer offerings, per today’s announcement.

Though the company didn’t disclose specifics regarding potential new product releases, it told Nosh via email that it remains “focused on continued innovation in clean-ingredient and ready-to-eat meals that are under $5.”

Tosi Snacks Raises $15M Series B, Names New CEO

Tosi Snacks has installed its board chair, Kevin Rutherford, as CEO and raised a new tranche of funding to fuel new marketing campaigns in the coming year.

The announcement came as the Anaheim, Calif.-based company closed a Series B round of nearly $16 million, led by previous investor Cambridge SPG.

Founded in 2012, Tosi makes USDA Organic certified, gluten-free, vegan meal and snack bars and clusters sold in over 1,200 U.S. stores as well as in Dubai, Hong Kong and the Dominican Republic.

Tosi previously announced a “significant multi-million dollar” funding round in 2018, also led by Cambridge SPG. The current round included other previous investors who have remained undisclosed.

Tosi’s Series B round “marks an important capital milestone for Cambridge SPG, which has invested over $250 million of equity in the organic food sector,” said Cambridge Companies SPG managing partners Filipp and Polina Chebotareva in a written statement.

“We are committed to investing hundreds of additional millions in this sector going forward because there is such a strong need to clean up the broken food system in America,” the partners said.

Cambridge SPG’s portfolio includes other food and beverage brands like Once Upon a Farm, The Coconut Cult, Sol-ti, Vive Organic, Suja, 4th & Heart, Lifeaid Beverage Company and Starbird Chicken.

With the blessing of Cambridge SPG, mother-daughter co-founding team Stefanie and Chelsea Hults had encouraged Rutherford to take on a more hands-on leadership role in Tosi’s day-to-day operations. He became board chair about two years ago.

The Hults will remain in “critical roles” as the team evolves into the new leadership structure and “builds out lanes” in job responsibilities, Rutherford said.

“Obviously, these two founders did everything and now just can’t do everything because we are about to scale to a whole different level,” he said.

Rutherford said he was ready to jump back into leading a team where he could directly impact a brand’s trajectory. Drawing from his marketing and leadership roles at companies like SC Johnson, Miller Brewing Co., Kashi and Nuun Hydration, Rutherford will help steer the brand’s efforts in building out awareness and trial. The new funding will most directly go towards more marketing spend on demos and sampling.

The business has grown sales about “300% for the last couple years,” Rutherford said, but is ready to add more fuel to the fire in not only its wide retail distribution network but also in ecommerce channels, where it has been focusing in the last year.

“There is real energy behind the brand. Interest in Tosi remains strong,” Rutherford said. “Consumers are looking beyond the overly used term ‘better-for-you.’ That’s what Tosi is. It’s very distinctive and highly differentiated.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe