After taking a hard look at its distribution and retail partnerships, Genius Juice is taking a strategic shift away from growth at all costs and towards profitability after a tumultuous end to its distribution partnership with KeHE.

Facing headwinds while attempting to push into conventional grocery, Genius Juice co-founder and CEO Alex Bayer told BevNET last week that his SoCal-based brand of refrigerated coconut smoothies is now focusing more on direct-store distribution and its regional partnerships while preparing to launch a soon-to-be-released wellness shot in May. Distribution and retail partnerships are also being reexamined to identify where it has the most opportunity to “boost margins and increase profitability.”

Troubles With KeHE

That reexamination included a hard look into its relationship with national distributor KeHE.

Bayer – in the past an outspoken proponent for small CPG food and beverage brands – detailed his rocky working relationship with KeHE on LinkedIn in early February. In a series of posts and on his weekly livestream, Bayer spoke about “erroneous” chargebacks, high distributor fees and a flawed ordering system that have resulted in numerous out-of-stock issues or spoilage that translate to additional costs or missed opportunities for the brand.

At one point, Bayer wrote that Genius Juice was “purposefully avoiding retailers that only go with KeHE.”

“If I had a choice, I would NOT do business with Kehe, because, in our experience, they kill margins, they abuse chargebacks, and their freight review process is borderline unfair and abusive,” Bayer wrote in the post.

Reflecting on the situation now, Bayer stands by his earlier sentiments.

“Unfortunately, I’ve heard that many brands have complained and voiced concerns with KeHE and very little has been done,” he told BevNET. “Our experience at Genius Juice was after listing all these challenges, they did nothing.”

Bayer’s situation is illustrative of the at-times fraught relationship between developing brands and their route-to-market providers. His complaints resonated with many in the emerging brand community, and extended discussions followed online, with one of his posts generating over 300 reactions and 114 comments.

In a subsequent post, Bayer reported that, as a result of his comments, a KeHE senior category manager had emailed him and set up a 40 minute Zoom discussion with seven other upper management Kehe team members to talk through the issues brought up in the post. Although initially optimistic that the meeting would lead to a resolution, Bayer reports that the two companies have ended their partnership. In the meantime, Genius is continuing to work with UNFI and exploring options with regional distribution partners to fuel its growth moving forward.

“After receiving Alex’s feedback regarding his recent experience with KeHE, the team quickly reached out to set up a conversation to discuss how we can work together,” wrote a representative from KeHE in an email statement. “We will continue to support emerging brands like this moving forward through KeHE supplier growth programs, education & communication, and data & analytics. We wish Genius Juice continued success in the future.”

Betting On Functional Boosts

Looking to turn the page on that chapter of the company, Genius Juice has sifted strategy to go deeper into metro markets with higher concentrations of natural stores, independents, foodservice and coffee shops.

“We realized it’s not about entering into 2,000 new doors under conventional, but focusing on 100 really high-quality doors in our backyard or in other metro cities where we have proven success in the past,” Bayer said.

Moving forward, Genius Juice is focusing on regional markets like Los Angeles, San Francisco, New York and Seattle with more emphasis on DSD. Part of that decision comes from the “tougher economic climate,” Bayer said, “where money is drying up, and it’s harder to raise significant capital right now unless you have a really strong story with your sales.”

Yet Bayer, a Shark Tank alum, has faced down funding pressures before. At the beginning of the month, the brand closed a crowdfunding campaign on Republic.co that netted over $31,000 to help launch a line extension: a three-flavor line of 2 oz. refrigerated shots called Genius Boost Shots featuring nootropic ingredients like functional mushrooms and B vitamins that will retail for around $3 per bottle. The new product is expected to hit the market in late April/early May and is repositioning the Genius brand more heavily in the functional, wellness space.

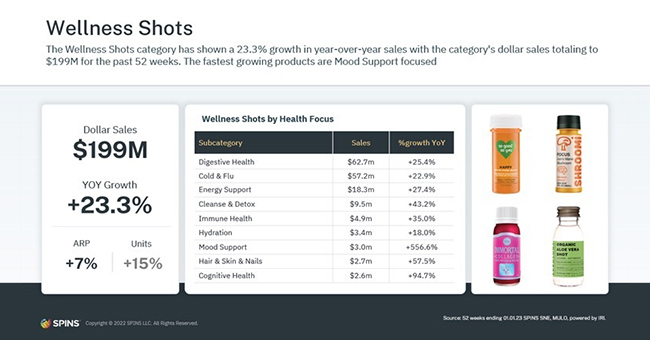

The opportunity in wellness shots has grown 23.3% year-over-year accounting for $199 million in sales, according to SPINS data for the 52-weeks ending January 1. The subcategories of mood support (+556.6% YoY) and cognitive health (+94.7% YoY) are making big strides in consumer demand.

“It centers on improving focus, energy, clarity, lifting brain fog and also includes other cognitive and mental benefits for the consumer,” Bayer said. “We felt, as a company, this ties in much better with our ‘Genius’ branding.”

This story has been updated to include a statement from KeHE Distributors.