Brown-Forman announced yesterday a -8% decline in reported net sales to $1.0 billion in Q4 FY 2024 driven by lower volumes of tequila and whiskey, and the broader slowdown in the spirits industry.

Brown-Forman announced yesterday a -8% decline in reported net sales to $1.0 billion in Q4 FY 2024 driven by lower volumes of tequila and whiskey, and the broader slowdown in the spirits industry.

Here’s the overview:

- For the full year, the company’s reported net sales decreased -1% to $4.2 billion compared to the same prior-year period.

- Operating income increased +25% to $1.4 billion in the year, and increased +26% to $375 million in the quarter.

- Reported gross profit increased +1% for the full year with gross margin expansion of 150 basis points to 60.5%. The increase in gross margin was driven by price increases and lower supply chain costs, which helped counter higher material costs such as agave and wood barrels.

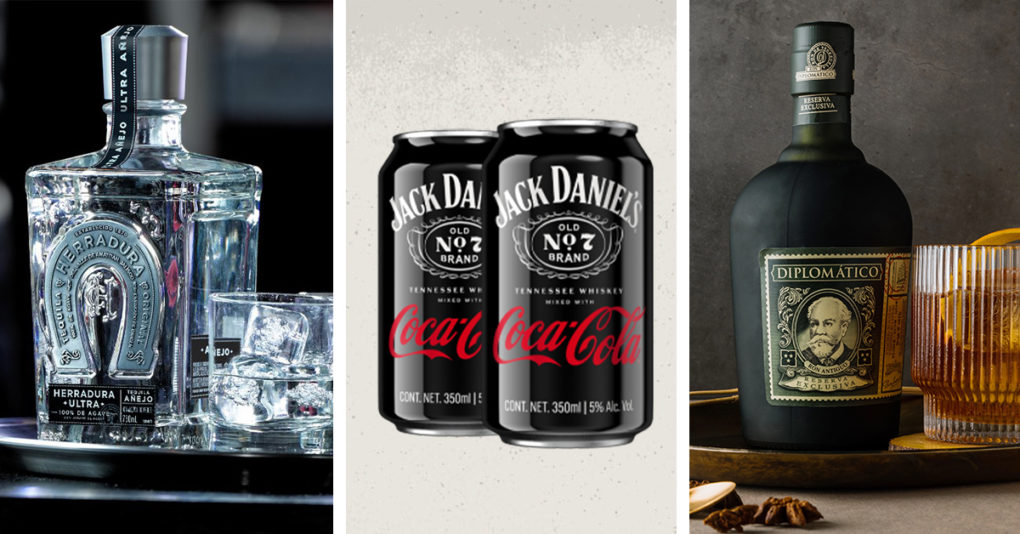

- Advertising expenses grew +4% driven by increased investment in Jack Daniel’s Tennessee Whiskey, Diplomático and Gin Mare brands, and the launch of Jack Daniel’s & Coca-Cola RTD.

Overall, reported net sales in the U.S. decreased -4%, with the decline partially offset by price increases, led by el Jimador and Woodford Reserve, and the growth of superpremium Jack Daniel’s expressions.

Zooming in on the whiskey portfolio, down -3% in net sales: lower volumes for Jack Daniel’s Tennessee Whiskey and Jack Daniel’s Tennessee Honey drove the decline and reflected an estimated net decrease in distributor inventories. The losses were partially offset by the growth of Jack Daniel’s Tennessee Apple and the rest of the group’s whiskey portfolio, including Glenglassaugh old and rare cask sales.

The tequila portfolio also suffered losses, with net sales decreasing by -4%. Net sales for Herradura declined -10% led by lower volumes in the U.S. while El Jimador’s net sales were flat, also driven by lower volumes in the U.S. and Mexico, but offset by higher prices.

Bright spots include recent acquisitions Diplomático Rum and Gin Mare, which drove the rest of the portfolio’s sales with combined net sales growth of +61%.

A highlight of the RTD portfolio, New Mix also grew +32% fueled by higher prices. RTDs overall delivered net sales growth of +2%. Sales of the Jack Daniel’s RTD portfolio declined -6% driven by lower volumes of Jack Daniel’s & Cola RTD, partially offset by the switch out with the launch of the Coca-Cola collaboration.

The group maintains an expectation of organic net sales growth in the 2% to 4% range, and cited pricing as a lever to continue to generate growth.

Despite the normalizing market causing sales lags for other spirit companies, CEO Lawson Whiting was optimistic that trends would improve towards the Fall and Winter and said that the downward trajectory was primarily an “inventory correction” issue at the consumer level.

“We do think that the pantries are not as full as they were a year ago, and it just depends a little bit by when the consumer comes back and starts spending in a big way,” he said.