National Cider Month: A Call for Collaboration in the Hard Cider Segment

For most folks, October is the time to bring old sweaters out of storage, indulge in pumpkin-flavored-everything and grab a last-minute Halloween costume. For Schilling Hard Cider, October is its Super Bowl.

Seattle-based Schilling is the leading cidery behind National Cider Month (NCM), a brand-agnostic campaign to promote the hard cider segment with demonstrations, retail activations and digital marketing.

More than 150 cideries participated in NCM this year, up from 60 in 2023, and more than 300 events and in-store demonstrations were held, according to Schilling CMO Rachel Thomas. And those figures only include folks that submitted events and campaigns to the official NCM website, a one stop shop for NCM assets, hard cider education resources and event listings.

Several trade groups also participated this year, including the U.S. Apple Association, American Cider Association (ACA), Cider Institute of North America, Iowa Brewers Guild, Michigan Cider Association, Minnesota Cider Guild, Northwest Cider Association, Pennsylvania Cider Guild and the Utah Cider Association.

“There’s just more buy-in this year overall,” Schilling CCO Eric Phillips said “There was more awareness about it, there was more participation overall, there was more excitement, there was more enthusiasm.”

2024 marked year five of NCM (previously National Apple Month), but only its second year as a national campaign with programming across the U.S.

“Last year was, ‘Let’s start it. Let’s learn about it as it goes national,’” Phillips said. “This year was, ‘Okay, let’s go a little bit further.’”

In 2023, Whole Foods became a prominent retail partner for NCM, joining after a conversation between Mary Guiver, Whole Foods global principal category merchant for beer, and Schilling leadership at the 2022 Brewbound Live business conference. The grocery chain partners with local and regional cider brands on displays and placements.

Now, NCM has garnered enough traction and created enough growth for the segment, that other retailers and major distributors are carving out space for NCM in their annual business plans.

“You’re talking about Columbia, Reyes, Hayden, Crescent Crown, Coors Distributing,” Phillips said. “You’re talking about some heavy hitters who are already earmarking it for next year.”

Schilling Cider is the driving force behind NCM, but the company insists that the campaign is brand-agnostic, and meant to help build greater awareness for the total hard cider segment, whether it’s limited release bottled farm ciders, or nationally available brands.

“We have an opportunity as stewards in the industry specific to cider to help foster a community of growth,” Phillips said. “We can’t grow a category solo, we need other people.

“We’re at this point where it’s like, ‘Hey, I promise there’s not like, some secret, dark thing that we’re trying to do on the back end, like we’re not puppeting,’” he continued. “We are trying to help you grow your site or share as well in your market. Here are some tools, and here is a nationally designated program that can do that.”

Still, Schilling isn’t completely selfless in its efforts. The company recorded its “best month ever” in October, increasing dollar sales +24% versus October 2023, which was its previous best month. More than 20 major retailers increased their Schilling sales during NCM versus year-to-date (YTD) trends, and California became the company’s fastest growing market, increasing dollar sales +74%, thanks in part to support from Schilling’s distributor partner Reyes, according to Phillips.

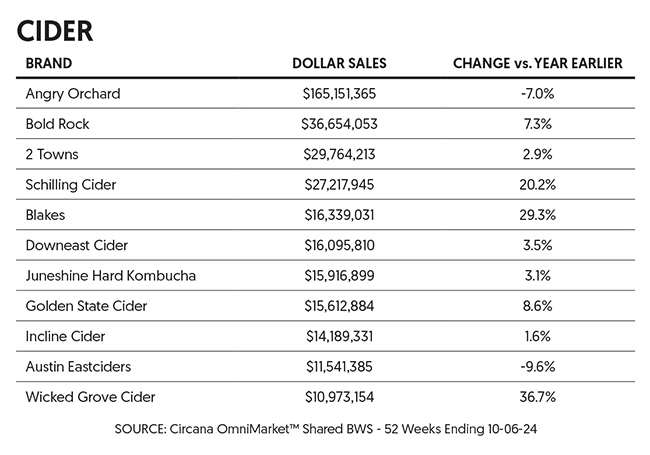

NCM efforts come as hard cider finds itself in a time of transition. The segment was long dominated by national players such as Boston Beer Company’s Angry Orchard, still the No. 1 shareholder. National brand declines dragged down the overall segment trends, creating the perception that hard cider couldn’t grow and connect with consumers. But behind the scenes, regional cideries were finding opportunities and working to eliminate hard cider stereotypes with consumers. Two years ago, regional cideries passed national cider brands for more than 50% share of the segment.

Hard cider is still recording losses, impacted by continued declines by major brands, including Vintage Wine Estates’ Ace Cider, which recently filed for Chapter 11 bankruptcy and was sold at auction. YTD through November 2, hard cider dollar sales have declined -1.8% and volume -3.8% in NIQ-tracked off-premise channels, according to data shared by 3 Tier Beverages.

However, the data looks much rosier when looking at regional trends, especially with the NCM boost. Eight of the top 10 cider suppliers increased dollar sales growth in Circana-tracked off-premise channels in the four-week period ending October 27, according to data shared by Schilling. Total cider dollar sales also increased +20% in the four-week period versus summer trends.

“It’s a category that’s poised for growth, it just happens to be cider, right?” Phillips said. “The conversation with our distributor partners is, ‘What are people looking for?’ People are looking for flavor, and then people are looking at high ABV – those are two of the top determining factors if you’re going to purchase, and cider has that space.”

A continued hurdle within the segment is “a gap in quality” among offerings, though that is changing, Phillips said. That’s not just regional cidery efforts, but also Angry Orchard reformulating its core offerings.

Additionally, the segment is still burdened by consumer education. It takes work to show how many different brands of hard cider are available in the market, or what different styles of hard cider there are, including the difference between semi-sweet, semi-dry and dry cider, according to Thomas.

“Just by putting that on the can, it starts the conversation of, ‘Oh, this is what a dry cider is,’” Thomas said.

American Cider Association CEO Michelle McGrath to Leave Trade Group

While hard cider continues to find its collective voice, one of its loudest advocates is moving on. ACA CEO Michelle McGrath is leaving the trade group at the end of the year.

McGrath will depart the ACA after more than eight years, with a new role as Columbia Basin program director at Salmon-Safe, an ecolabel company that helps protect farms and developments in Oregon, Washington, California, Idaho, Wyoming and British Columbia.

McGrath joined the ACA in 2016 as the group’s executive director and first CEO. At the time, the ACA was the United States Association of Cider Makers, and was rebranded in 2020.

“I’m really proud of what the board, staff, volunteers, partners, and members have accomplished together over the last 8+ years,” McGrath said. “It’s been a true honor to work with such inspiring people, and although I am ready to move to the next phase of my career, I will cherish my time and the relationships I’ve built at the ACA forever.

“It’s hard to express how much the people in this industry mean to me, and I’m incredibly grateful for the friendships and memories made. I was a cider fan before I took the reins at the ACA, and I’ll be a cider fan for life!”

Whoever fills McGrath’s shoes will be following in the steps of a laundry list of accomplishments, including a reimagining of the ACA and its role. McGrath led the trade association as it expanded by more than 60%, to nearly 800 members, and more than doubled its annual revenue.

McGrath was also a part of organizing and leading eight of the 14 CiderCon events, the largest cider industry event in the world. The 2024 event, held in Portland, Oregon, set a new registration record and had 1,100 attendees, despite ice storms in the area.

Legislative accomplishments achieved during McGrath’s tenure include:

• The 2020 approval from the Alcohol and Tobacco Tax and Trade Bureau (TTB) for 12 oz. packages of wine, mead and hard cider that are more than 7% ABV, (comments for 16 oz. and 19.2 oz. allowances recently closed);

• Permanent passage of the Craft Beverage Modernization and Tax Reform Act in 2020, along with other bev-alc trade groups;

• The introduction of the Bubble Tax Modernization Act in the House of Representatives this year, which would increase the allowable carbonation levels for fruit cider, fruit wine and fruit mead that are under 8.5% ABV.

McGrath also helmed the ACA in its recent collaborations with the Brewers Association (BA), including recently adding hard cider to the Great American Beer Festival (GABF) and its corresponding beer awards.

McGrath told Brewbound that she’s most proud of the ACA’s advocacy work, adding: “I hope there are some exciting advancements before the end of the year to celebrate more achievements. Cider deserves parity with beer, wine and spirits.”

Asked about her wishes for the ACA’s future, McGrath said: “The ACA has grown largely by creating an environment that is welcoming for all to experience cider. My hope is that [an] approachable, friendly atmosphere continues to grow, and that cider keeps lifting each other up. If cider continues to embrace diversity, the category will thrive for years to come.

“My wish for the allied trade industry is to look at cider as a stand alone category, and to give the category the nuance you would give wine, beer or spirits. I think we’ve more than proven cider is its own category. I hope that can be part of my legacy.”

And what will McGrath have in her glass for her farewell toast?

“I’m not sure what cider it will be, but it will definitely be a bittersweet one (cider joke there for the cider nerds).”

Hard Cider Celebrates First Year in GABF Awards

More than 270 breweries and cideries won medals at GABF, held in October in Denver.

The BA awarded 326 medals to 273 competitors in the 38th year of the competition and 42nd year of the festival. Up to 327 awards were available, but a bronze medal was not awarded for amber-to-dark non-alcoholic beer, according to a press release.

This year’s competition was hosted in partnership with the ACA and included five cider categories for the first time. This was also the second year the BA allowed hard cideries to pour during GABF tasting sessions.

In addition to the new categories, 280 offerings were first-time GABF entrants, and 25 were first-time winners.

The most-entered hard cider category was fruited and botanical cider, with 74 entries. Portland, Oregon-based McMenamins Breweries’ Blackberry Cider took gold, followed by Ozark Beer Co’s Ozark Strawberry Rhubarb Cider (Rogers, Arizona) and 2 Towns Ciderhouse’s Pacific Pineapple (Corvallis, Oregon). Cidermaker of the Year was awarded to 2 Towns Ciderhouse.

Other gold medal winners include:

• No/Low Tannin Cider – The Russets from Snow Capped Cider (Colorado);

• Tannic Cider – Classic Dry from Gowan’s Cider (California);

• Fruit or Botanical Cider – Blackberry from McMennamin’s Edgefield Winery (Oregon);

• Experimental or Barrel-Aged – Rosé Cider from Gowan’s Cider;

• Single Varietal – Mountain Rose from Haykin Family Cider (Colorado).

The ACA celebrated the partnership, promoting post-GABF thoughts from cider judges, including Max Finnance, a beverage consultant, certified pommelier, master cicerone and five-time GABF judge.

“Hearing the incredible conversations among some of the cider world’s leading minds, and helping to select the best of the best over three days of judging, it only makes me more excited about the future of cider at GABF,” Finance said in the release. “As consumers continue to get more diverse with their beverage choices, a partnership like this between the preeminent cider and beer organizations in the country makes a ton of sense to me, and has the ability to help catapult the best cidermakers into visibility for a whole new audience.

“I guarantee that Gowan’s, 2 Towns, Haykin Family, and the rest of the winners all experienced a spike in web queries over the weekend, something that other cideries will be smart to strive for in future years.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe