Reviews: Recess, Dad Grass Take on Dry January

Just in time for Dry January, this week’s reviews features two brands specializing in alcohol-free relaxation, including a winter-themed mock-tini and a functional “leisure drink.”

Just in time for Dry January, this week’s reviews features two brands specializing in alcohol-free relaxation, including a winter-themed mock-tini and a functional “leisure drink.”

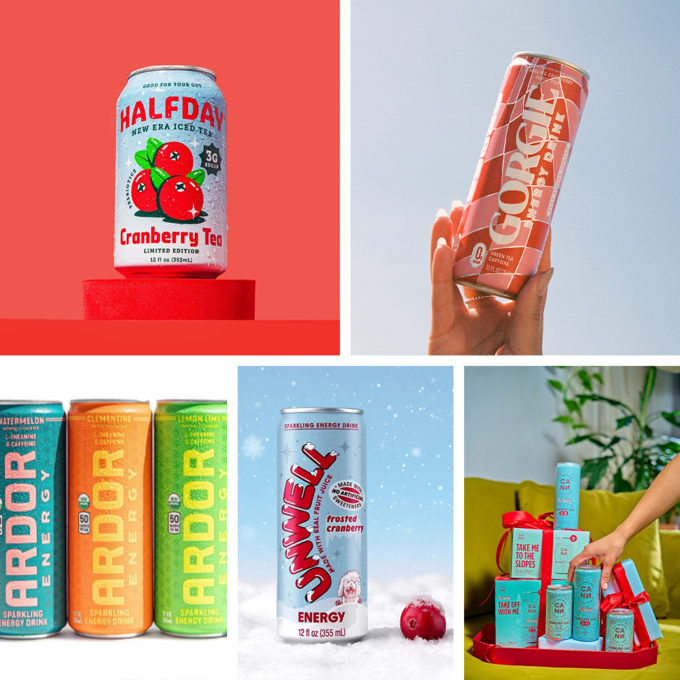

Cranberry is the holiday flavor popping up in seasonal varieties from drink makers like Gorgie, Halfday, Unwell and Cann.

Recess Drinks has closed a $30 million series B round led by existing investors including CAVU, while Kyle Thomas will be joining founder Ben Witte as co-CEO and President.

Relaxtion drink Trip is making good on its goal for US expansion in 2025, announcing today the release of a new flavor and distribution, as well as a hiring of Abby Redick as SVP of Sales.

The adult non-alc category is on its way to hitting $1 billion in off-premise sales as new entries shake up the top brand families and begin to drive prices down, according to market research firm NIQ.

There’s a good reason why classics never go out of style, as proven again in this week’s reviews, highlighted by updated takes on familiar favorite flavors from Poppi, Recess and Lapo’s.

The adult non-alcoholic (ANA) beverage category has been driven recently by demand for functional options intentionally crafted to have an effect and positioned toward experiential occasions.

Our latest news roundup from Expo West 2024 highlights a fresh approach from Weird Beverages, how Recess and Parch are growing the retail footprint of adult non-alcoholic drinks, and plant-based innovations from Forager Project and MALK.

While Recess’ core hemp-infused drinks continue to develop, their traction has been outpaced by the growth of Mood, a 4-SKU non-CBD line that promises similar relaxation and calming benefits and features magnesium as its star ingredient.

In this weeks distribution roundup: Recess and Breakthru Beverage Group partnership continues CBD distribution wave, Mad Tasty now at Sprouts, blk. expands presence at Walmart, BioSteel joins WB Canna Co. & Wellness’ Latin America and Carribean portfolio and 7-Eleven partners with Minibar Delivery.

If it is passed and signed into law by Gov. Gavin Newsom, as is widely expected to happen within weeks, California Assembly Bill 228 will declare that foods, beverages and cosmetics made with industrial hemp should not be considered as adulterated. Until that occurs, however, brands and retailers in Southern California still face an uncertain existence from day to day.

In this roundup of People Moves, Essentia’s SVP of sales moves to emerging hemp-infused beverage maker Recess. Meanwhile, ROAR Organics appoints a new VP of sales, while Riff Cold Brewed announces Julie Galbraith as its new CMO.

In 2019, the beverage market saw a veritable flood of CBD-based beverage innovations. Although competition in the space may be tight, CBD beverage leaders are now looking to work together to take the category out of legal limbo and into the mainstream.

The industry vet, who previously held positions at Jones Soda Co, Starbucks and Stumptown, told BevNET he connected with More Labs CEO and co-founder Sisun Lee last year and joined the company as a retail sales advisor to its board last March.