Sour Milk: Plant-Based Dairy Strategizes Around Simplicity Amid Slumping Sales

Plant-based milk is looking for fresher soil.

While oat milk lattes and almond milk creamers have become a mainstay at most coffeeshops, retail sales for plant-based dairy have declined in the last year.

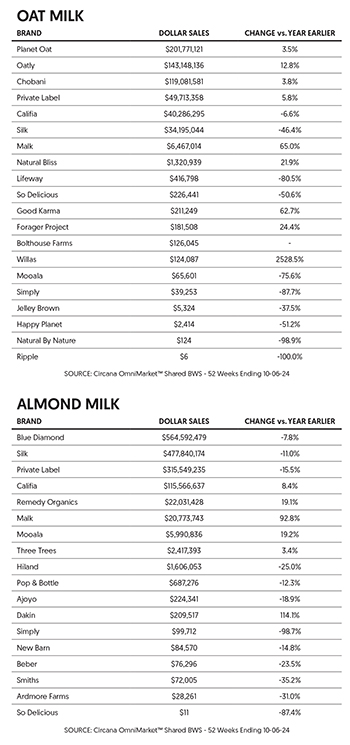

Non-dairy sales have declined faster than dairy milk in the past year. Plant-based milk sales were $2.5 billion in the 52-week period ending October 6, a 5.2% year-over-year decline, according to Circana MULO+C data tracking. Unit sales in the period also dropped 5%.

The percentage of households buying plant-based dairy was down 2.1%, to 49%, while repeat buying households were also down 2.2%, to around 38%

Almond milk, the long time leader in plant-based dairy, happens to also be leading the decline. In comparison to the other three major plant milk bases (oat, soy and coconut), almonds showed the most contraction. Dollar sales for almond milk were down 8.9% and unit sales also declined 8.6%.

Is there a single overriding reason that plant milks are in decline? It’s hard to say. Inflation hit grocery shoppers in the past two years, but the price difference isn’t huge when it comes to the different milk types: according to Circana 52-week sales data, the average price-per-unit of plant-based milk was about $4 while dairy milk was around $3.50.

And even if price is a concern, it doesn’t seem to be one with regard to at least one area originally thought to be an advantage for plant-based milks. Lactose-free consumers aren’t moving away from dairy, according to NielsenIQ, even though Lactose-free dairy is more expensive than its plant-based competition, which is naturally free of that dairy protein, according to the report.

Danone’s decision to discontinue its Silk Nextmilk and So Delicious Wondermilk just over a year after launching reflects a miscalculation of alt-dairy consumer demands. The two products were formulated to replicate dairy milk and were marketed as the “future of plant-based beverages.”

So what went wrong? At least one analyst seems to think that plant-based products are an imperfect substitute in a big consumer category.

Products claiming to be direct stand-ins for dairy need to deliver on that promise, said Mintel Food & Drink analyst Julia Mills, because “if it’s not quite milk, when it comes to the taste and texture, it doesn’t really appeal to consumers.”

Another issue is environmental impact. Shortly after almond milk took off, there was a backlash against its taxing production process, even if it offered a less damaging water usage and methane emission footprint than dairy milk.

Finally, there was a tactical miscalculation: while alt-milks are being introduced through coffee shops, those high-froth “barista blends” aren’t necessarily what consumers want for other use cases.

So knowing that things are moving, at best, sideways, due to taste and cost factors, what are brands to do?

Leaning into Premium

MALK is one of the fastest growing brands in the plant-based category. Though still significantly trailing category leaders in total dollar sales, MALK’s percentage growth outpaced bigger brands by wide margins, up 92.8% in refrigerated almond milk and 65% in oat, according to Circana tracking.

The plant milk brand is one of the more expensive options in the cold case but the company sees that as more of a strength than a weakness.

“Premium is who MALK is,” Bronstad said. “We don’t have the ability to drastically reduce our cost of goods by adding oil into oats or gums and fillers into almonds and we don’t want to. It’s not what we would serve our families.”

Premiumization hasn’t stymied the brand’s growth in conventional stores either. The company is available at over 10,000 stores with partnerships outside of the natural channel in chains like Albertson’s, Stop N Shop, Publix, various Kroger banners and select Target locations.

Malk’s emphasis on simplicity is echoed by analysts and competitors alike.

“Over 25% of consumers who choose to buy plant-based milks, say they prefer simple ingredients or ingredients they can understand,” Mills said.

Launched first in Houston, Texas, MALK has always stressed its simple, clean label – even as the overall category has slowed.

“At one point, there were pundits that said it was going to be hockey stick growth and plant-based milk would be $10 billion by 2030,” MALK CEO Jason Bronstad told BevNET Magazine. “The reality is it hasn’t and that’s okay too.”

Bronstad said that the target plant-based milk consumers are the same people who look at ingredient labels closely and make purchasing decisions on what they put in their bodies.

“As consumers become more educated and ask more questions, they look at our label and see unsweetened almonds, water and organic, pink Himalayan salt,” he said. “They think: ‘Got it. I understand what I’m consuming.’”

Other brands are seeing the advantages of taking a minimalist approach to formulation as well. In January, category giant Oatly released Super Basic, free from emulsifiers and stabilizers and containing just water, oats, sea salt and citrus fiber.

Macadamia nut alt dairy maker Milkadamia also cut out additives in its Organic Artisan line released this year. The plant milk uses five ingredients: water, macadamia nuts, agave nectar, citrus fiber and sea salt.

Mooala launched in 2016 with a nut- and soy-free, banana-based milk. Come 2023, however, it launched its Simple line in almond and oat that proclaimed it contained just water, salt, and oats or almonds.

Simple speaks to a consumer “that values a homemade ingredient profile over added nutritional benefits,” said founder and CEO Jeff Richards. “If a product has just three or four ingredients that you would find in your kitchen, it doesn’t have to be explained. It just is what it is, and it’s real.”

So how did plant-based milks get into a paradigm where something that can be made with three to five ingredients is all of a sudden a confusing “Frankenfood”?

One issue comes from the very channel where oat, almond and soy have found their biggest opportunity: foodservice partnerships in coffee chains. In order to create alternative milk that can steam and froth like dairy, a fat, stabilizer, and/or emulsifier is needed to provide body to the liquid.

“The market demands customization and performance,” noted Mooala’s Richards, who said that the need to capitalize on the opportunity in coffeeshops led to the release of a Barista Blend Oatmilk this summer in both conventional and organic varieties.

Yet coffeeshop-positioned products don’t necessarily translate to retail easily, Mills said.

“Consumers really appreciate versatility,” she said. “Consumers may not buy barista-style alt-milks because they think there is just one use. While it can meet specific needs and a niche, it doesn’t necessarily have mass appeal.”

Adding Valuable Nutrition For Little Milk Drinkers

“Plant-based beverages appeal to millennials, who are today’s generation of parents,” said Danone SVP of plant-based beverages Kallie Goodwin. “Nearly three in four parents who purchase plant-based beverages are interested in purchasing plant-based options specifically for their kids, but finding a plant-based milk with a taste kids love, and nutrition parents want continues to be a challenge.”

Boosting nutritionals has become a successful strategy for plant milks to establish lasting value for shoppers, especially those with children, Mills said.

“It appears that these products are doing very well, based off sales data,” she said. “I think leaning into specific occasions, whether it be for children or snacking with smaller packaging sizes, offers a lot of room for opportunity.”

Fortification, usually with vitamins A and D, has been an approach implemented for years by the dairy industry that has been adopted within the plant-based set.

In February, Califia Farms launched its Complete product that claimed it had the same amount or more of the essential nine nutrients (Protein, Calcium, Vitamin A, Vitamin D, Vitamin B12, Magnesium, Phosphorus, Potassium, and Riboflavin) found in dairy milk. The brand doubled down on that with the addition of Complete Kids Plantmilk in June.

Seizing on an opportunity among a demographic who still drinks milk by the glass, Danone launched Silk Kids fortified with 8 grams of protein, DHA omega-3s, choline, prebiotics, and vitamins and minerals tailored to children’s health needs.

It’s not just kid-positioned alt-milk either. Goodwin said Silk’s launch of Almond Protein (with 8g protein) is showing traction among consumers.

Bucking the trend of simplification, there are brands taking fortification even further by using food technology to bring functionality to the mix. Strive Freemilk uses precision fermentation in its alt-milk production and is preparing to release a lactoferrin-fortified product positioned towards older adults needing a supplement boost.

Sustainability Questions Loom Over Almond

Marketing on functionality and nutritionals might be a value-add for plant-based but it does return the conversation to a core tenant of the plant-based category’s marketing strategy: environmental sustainability. Food tech companies often claim to reduce land and water use providing a more environmentally friendly option but consumers remain skeptical.

As consumers still determine how they feel about food tech solutions, the unsustainability of almond trees for alt-dairy production is a common refrain. Insurgent plant milk brands offer a different option, a new nut.

Pistachio-based Táche has grown its base out of the New York City area on the back of its flavor, its environmentally sustainable attributes and its cachet among coffee drinkers. The brand’s success in the foodservice channel led it to launch a RTD latte earlier in the year.

PKN pecan milk is another plant-based alternative “benefitting” from consumer concerns over the longterm sustainability of almond production. PKN founder and CEO Laura Shenkar launched the brand after working in freshwater ecosystems and groundwater preservation. She saw an untapped potential for pecan-based alt milk because the nuts come from one of the few drought tolerant trees indigenous to the U.S.

The opportunity in pecan milk lies in marrying the environmental concern that fuels some consumers’ choices with the nostalgic flavor of a culturally significant crop.

“Texans are convinced that their pecans are the best, but the people of Mississippi, Alabama or Georgia also consider their pecans the best,” she said. “Pecans are an American mainstay. They’re very specific to America, and they’re very specific to family.”

Tapping that nostalgic nerve and familiarity of flavor resonates with consumers who are looking for an emotional attachment when making purchasing decisions. The brand has invested in new products that play into plant-based trends: JOY Barista and ZERO which contains only pecans, water, vanilla extract and salt.

“What I keep thinking about personally is my diet keeps getting smaller and smaller and smaller. You can’t eat this and you can’t eat that, and now you can’t do this and you can’t do that. What do we have left?” she said. “Let’s make the most out of what we have left.”

Receive your free magazine!

Join thousands of other food and beverage professionals who utilize BevNET Magazine to stay up-to-date on current trends and news within the food and beverage world.

Receive your free copy of the magazine 6x per year in digital or print and utilize insights on consumer behavior, brand growth, category volume, and trend forecasting.

Subscribe