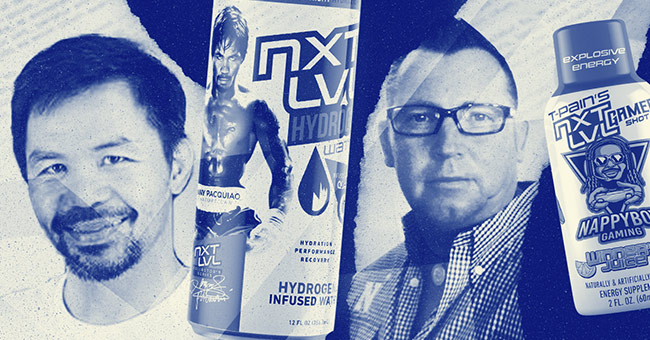

Last year, Takeover Industries, the maker of hydrogen water and gamer energy shot brand NXT LVL, appeared to be riding high. Supported by a joint venture with the legendary boxer Manny Pacquiao and his charitable foundation, and with hip hop artist T-Pain lending his brand and image to the company’s products, NXT LVL had broken ground in 7-Eleven, Sprouts and MAPCO. In due time, the company’s president told shareholders in a May 2022 letter, the business was on track to have products in upwards of 40,000 doors nationwide.

Eight months later, the products are largely off shelves, the celebrity partners have gone quiet and the Nevada-based business and its founders are navigating multiple lawsuits from shareholders who say they were misled and defrauded by the publicly listed company.

Among the claims made in the court filings are allegations that Takeover’s founders used the company as a personal bank – wrongfully moving money from corporate funds to their own holding company and charging tens to hundreds of thousands of dollars in personal expenses. One suit from shareholders accused the founders of lying about licensing and endorsement agreements with “Greatest of All Time,” or GOAT, athletes such as Tom Brady in order to pump its stock price on the over-the-counter (OTC) market. That complaint and another lawsuit, from Takeover’s largest individual investor, includes detailed allegations of an actual takeover of the company, one that ousted key employees in violation of a convertible note purchase agreement and reinstated embattled figures to top level positions.

The claims have been further complicated by the company’s failure to maintain Pink Current status on the OTC market and an ongoing effort to get in compliance with SEC rules after its ability to trade shares was revoked in September 2021. The dysfunction, shareholders say, has caused the value of their stock to plummet. At its height in April 2021, Takeover’s stock price had risen to over 8 cents per share with a total market capitalization of around $1 billion, one lawsuit stated. As of January 6, 2023, shares were valued at $0.0001 with a market cap of $788,903.

The founders, meanwhile, have pushed back on reports of wrongdoing and, in a statement the company sent to BevNET, are “working at a feverish pace to settle all outstanding claims against themselves and the company” in order to focus on rebuilding the NXT LVL brand. An investor in the company has now taken charge of the business and says he is working to settle all legal matters, restructure the company’s leadership, put sales back on track and employ a policy of transparency with shareholders.

“The Takeover Board and I are vigorously working to try and implement solutions for the issues that plagued Takeover,” wrote Tom Zarro, a representative for Takeover. “To that end, the existing team has been cooperative at every step, fully transparent and fully engaged in the solution.”

But Takeover still faces a regular barrage of accusations from social media users and its troubled journey, marked by infighting and litigation, suggests that the path that led the company to this moment appears to be anything but business as usual.

NXT LVL, Takeover Industries and Labor Smart, Inc.

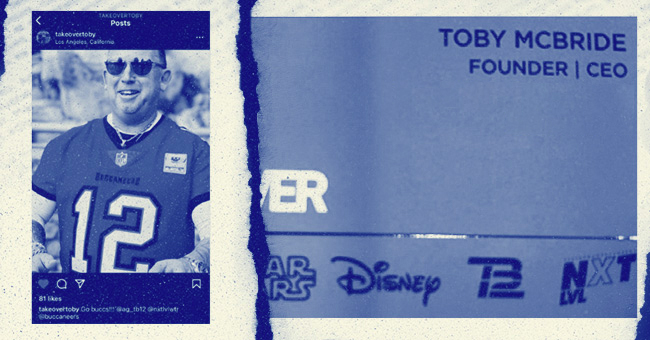

Takeover was founded in Nevada in January 2021 by CEO Toby McBride, CFO Michael Holley and chief science officer Joe Pavlik. Longtime beverage industry professionals, McBride and Holley have had a long working history together, including stints at Xyience and AriZona. Most recently they collaborated at Ignite International, Ltd., the CPG portfolio company founded by social media influencer Dan Bilzerian, serving, respectively, as CEO and COO of the IGNITE Beverage division.

Pavlik, based out of Fort Lauderdale, Florida, is the founder, president and CEO of material procurement company Flexus Group, according to his LinkedIn profile, and has previously held a variety of sales and marketing roles at dietary supplement and fitness equipment brands.

In various public statements, including a September 2021 interview on BevNET’s Elevator Talk program, McBride said the idea for the NXT LVL hydrogen water brand initially came to him directly from Alex Guerrero, the personal trainer of recently retired NFL star Tom Brady. Promotion around the brand has focused heavily on the drink’s functional benefits which it says is derived from “colloidal copper, gold, platinum & zinc. The actual product formula was licensed from its inventor, Danny Day, the founder of beverage manufacturer H2ForLife.

To launch the business, a pre-revenue Takeover sought to gain access to capital by quickly establishing itself on the public market and within the first two months of 2021 set about merging with an existing business in order to go public out the gate. The business was eventually identified in Labor Smart, Inc., a Georgia-based staffing company, incorporated in both Nevada and Wyoming, which had provided temporary blue collar labor across various industries and that was traded on the OTC market under the ticker symbol LTNC. Takeover was acquired by Labor Smart in a reverse merger on February 28, 2021. At its height in 2013, Labor Smart’s stock had reached about $0.73 per share, but market records show the price had fallen to nothing by the end of 2014 and had stayed valueless until its acquisition via reverse merger on February 28, 2021.

According to a press release from that March, Labor Smart president and CEO Ryan Schadel left the company at the close of the deal, retiring 500 million shares of the common stock from the tradable float in the process. Pavlik was named president and CEO of the parent company that now held Takeover Industries as a wholly-owned subsidiary and the company issued 6.8 billion new common shares. Initially, Schadel remained a board member of Labor Smart and said publicly that he intended to stay involved in order to advise in the transition, but he left the board by that summer and has since moved on to a new venture as the CEO of Metavesco, a publicly traded web3 liquidity provider which invests in NFT projects, virtual land and has recently begun Bitcoin mining.

“This particular deal, I believe, will take shareholders farther and faster than I ever could only doing staffing,” Schadel said in a live Twitter video announcing the acquisition. “The upside on this deal is insane. If we do this right and we execute, the revenue numbers that we put up previously will be an afterthought.”

That spring, Takeover entered a joint venture with the Manny Pacquiao Foundation (MPF), a nonprofit organization founded by the Filipino boxing champ and former senator. Pacquiao became a spokesman for the NXT LVL brand; a shirtless photo of “Pac Man” looking menacing was splashed on the side of cans and Pacquiao promoted the brand in multiple videos. As part of the agreement, the MPF agreed to help open up the Asian market for Takeover, aiding the procurement of manufacturing in the Philippines for distribution throughout the region.

Having locked in a major spokesperson and partner, NXT LVL set about expanding its team in order to begin establishing the brand in the U.S. market. In the spring of 2021, Takeover hired Jason Tucker, the founder and director of intellectual property management and anti-piracy services company Battleship Stance. Initially a consultant, Tucker soon joined full-time to serve as Takeover’s president and that June he would join the board of directors alongside McBride, Holley and Pavlik. The company further fleshed out its sales team with several new hires including VP of sales Michael Tzanetatos, national account director Michael Costello, and West Coast director of sales Trevor Nixon. It announced the hires as a sales “dream team” widely citing the experience of Tzanetatos, Costello and Nixon – all three of whom had recently worked at Ignite.

Over these first two years, Takeover and the NXT LVL brand appeared to be growing quickly and throughout 2022 it continued to announce high profile partnerships and retail gains. They kicked off the year in January with a multi-year sponsorship deal as the official water of the Professional Fighters League and the brand was also earning industry interest through a product line made in collaboration with Grammy winning rapper T-Pain – NXT LVL Gamer Shots – which the star regularly promoted on his social media accounts. NXT LVL even entered L.A. Libations’ SoCal Incubation Program (SIP), which helped to expand the products’ retail presence by opening up chains like Bristol Farms, Sprouts and 7-Eleven, although that partnership would conclude before the end of the year.

The company also took out numerous advertisements to promote NXT LVL, including through BevNET’s website and magazine, and had received media coverage on several cable news networks.

Speaking to BevNET editorial in May, Tucker said NXT LVL was in about 500 stores, and credited L.A. Libations with rapidly expanding its footprint across multiple channels.

But for all the growth the company was projecting publicly, and the daily online hype for its shareholders, Labor Smart Inc. had failed to maintain pink current status with the OTC market and by the end of September 2021 was no longer tradable. In his May 2022 letter to shareholders, Tucker shared that the issues came about due to poor record keeping by Labor Smart’s old management and the documents needed to keep the company in good standing with the SEC simply did not exist. Instead, the board agreed to spin out the Labor Smart common shares held in Takeover and re-establish the business separately in order to resume trading.

While LTNC share prices had collapsed, the letter also highlighted Takeover’s achievements in the market, including a CSP Retailer’s Choice award for Best New Product, and he projected that the Gamer Shots line was on track to be in over 40,000 stores (albeit without providing a timeline for when that goal would be met). He also sought to push back on rising social media criticism the company was now facing from those who had bought shares and were taking to Twitter, Reddit and stock trading boards to voice their anger.

“We endure regular attacks on social media, phone threats, text and other threats to us, our contractors, families, and vendors by villainous scum who stand in the way of capitalism. In the face of the hateful trolls, we have stayed on a road that will allow shareholders to benefit,” he wrote in the letter. “Simply put, we are going to take care of shareholders whether you want to hate on us or not.”

But even as the company was working to get shares trading again and posting about its sales and marketing triumphs, there was another drama playing out behind the scenes: Takeover was suing its own co-founder, Michael Holley.

Takeover vs. Holley

In early 2022, Takeover Industries filed a lawsuit in the United States District Court for the District of Arizona against Michael Holley and his wife Chirine Holley, alleging breach of fiduciary duties, conversion, and unjust enrichment. A bookkeeper named David Eisenberg and his wife were also named as defendants in the suit and accused of aiding and abetting tortious misconduct. The lawsuit was initially filed in California in January 2022 before being voluntarily dismissed, amended and resubmitted that March.

The complaint, which is signed by Tucker as president of the company, alleges that Holley had authorized over $750,000 in unapproved transactions from Takeover’s accounts, including the transfer of $51,500 to a company called One Elite Sports, LLC, which was owned by Holley and McBride. Among the allegations of using business funds for personal enrichment, the complaint accused Holley of quietly hiring his own daughter, charging “tens of thousands of dollars” in personal expenses, allowing his family to make personal purchases through Takeover, and failing to properly track payments or otherwise failing to pay third party vendors.

The suspect transactions only came to light, the lawsuit claims, in October 2021 – when Holley was hospitalized with COVID-19. Holley’s severe illness ultimately kept him in the hospital until late December, but it became apparent immediately to Tucker and the other corporate officers that Holley was the only one who had access to Takeover’s bank accounts, leaving them without any way to access money to make basic payments. When Holley was asked by Tucker and McBride for access to these accounts, he declined. Ultimately, the complaint states, Eisenberg provided a copy of the company’s bank records to Tucker, which Tucker believed revealed the supposed fraud, and in December Holley was, through a board vote, removed as a director and fired from the company.

However, Holley still refused to return company passwords and credentials for various accounts, including Takeover’s official email and Microsoft Outlook, “essentially holding the company ‘hostage,’” the complaint states. The lawsuit even suggests that Holley, “or someone acting at his direction” changed the password to the company’s web hosting account on GoDaddy so no one could make changes to the Takeover or NXT LVL websites.

In a counterclaim, Holley denied the allegations and asserted that he was improperly fired. He admitted in the document that he offered to turn over “the single password over which he had exclusive control … available for use upon the presentation of proof that he had been lawfully and properly removed from the Company,” but said the password was not handed over “because such proof was never provided”.

In the original complaint, Holley is alleged to have still, during this time, been paying personal expenses with his company credit card, including payments for a personal storage unit in Cave Creek, Arizona. He was also, the filing states, receiving checks paid to the company through a P.O. box in that town (various SEC records list a Cave Creek, Arizona address as both McBride and Holley’s place of business). The filing also claims charges were made to Holley’s corporate account for meals and other goods while he was still hospitalized, suggesting that others had access.

Holley filed a derivative suit against Tucker, Pavlik and McBride – which Pavlik and McBride have since settled but which Tucker is still fighting. In addition to denying the allegations against Holley, the response fires back – accusing Tucker of personally selling shares of LTNC common stock and failing to turn the payment over to the company. Takeover denied this in its response and filed a challenge to Holley’s standing for a derivative suit.

The derivative suit also argues that McBride, Pavlik and Tucker breached their fiduciary duty by failing to pay taxes to the state of Wyoming, where Schadel had incorporated Labor Smart in January 2020. According to the Wyoming Secretary of State website, Labor Smart was cited with delinquent tax notices twice, first in January 2021 – prior to the merger with Takeover – and again in January 2022. As of March, Labor Smart’s status in Wyoming was declared inactive. In their response, Takeover denied the claims, asserting that Labor Smart was only a Nevada corporation.

According to the derivative lawsuit, Holley and McBride agreed at the founding of Takeover to take a salary of $240,000 each in payments of $20,000 per month. However, the filing claims that they ultimately took uneven payments due to the nascent company’s variable cash flow.

“Holley and McBride also agreed to certain additional ad hoc payments for their services to Takeover. Such payments were also made to other affiliates of the Company, including Tucker and Pavlik, all of whom accepted the payments without objection,” the filing states. “All payments were duly authorized and recorded in Takeover’s books and records, which reflect that as of September 30, 2021, McBride was paid $352,000, Holley was paid $278,000 and Pavlick [sic] was paid $123,750.”

During witness examination in March, Holley said he was still paying bills for Takeover while hospitalized and that McBride had given him permission to allow his daughter to wire funds from his computer. As for the GoDaddy account – it was his own personal account registered several years before founding Takeover, he said, and that he did indeed intend to hold the accounts “hostage” until an agreement could be reached.

Holley also clarified the role that One Elite Sports played in the dispute: Holley and McBride used the company to loan Takeover Industries the money needed to start the business, he said, and that payments made to the One Elite account were simply repaying that loan. However, he admitted the loan was not documented in Takeover’s books.

“That’s how I formed Takeover, started the bank account with Takeover, paid for multiple different things,” Holley stated in the cross examination transcript.

McBride said in a written declaration filed in the original version of the case, from January, that he has been a “member and officer” of One Elite Sports, a beverage industry consulting firm, since the company was launched in partnership with Holley in November 2017. He also acknowledged the company has no employees and had not provided any services to Takeover Industries, adding he was unaware why the money was sent to One Elite: “I have no idea why that money would have been transferred from Takeover Industries,” he said.

However, Holley wasn’t the only one facing scrutiny for payments made from Takeover’s accounts. Further lawsuits also allege that during this time McBride spent over $243,000 in reimbursed expenses at the New York Yankees team store, the NBA Store in Manhattan and other locations that the plaintiffs say strain credibility as business expenditures – a charge, they say, McBride later admitted to the board.

As for Eisenberg, in his own submitted declaration the bookkeeper said he never had complete access to Takeover’s financial records and while working to update the books he would defer to Holley to learn the reasons for specific payments and which expense accounts to code them to. Eisenberg noted he is not a certified CPA and had no input into the company’s taxes or other accounting decisions, despite Holley identifying him as an accountant during witness cross examination – a claim he said he was “surprised to see” as “They know that I did not have that expertise, and they know that those types of tasks were never referred” to him.

This week, Takeover filed a motion to dismiss the claims in the Arizona suit against Holley and his wife, as well as the counterclaims made against Takeover. However, the motion maintains the claims against Tucker. As of this writing, an order on the motion has not yet been filed.

The Silence of the GOATS

The accusations made in the Arizona case against Holley have become central points in two other lawsuits from shareholders filed last month. The first, from a party of investors that includes Jon Sisson, executive director of the Manny Pacquiao Foundation, accuses the founders of spinning numerous lies to coax them into buying stock in the parent company Labor Smart.

The complaint, filed in the United States District Court Southern District of Florida, alleges that when shareholders purchased stock in Labor Smart throughout 2021, McBride, Holley and Pavlik had misled them to believe Takeover had secured multiple brand partnerships with various GOAT athletes, in particular Brady, as well as agreements with the Walt Disney Company and some of its media properties. Beyond direct comments from the founders, including promises that NXT LVL would be sold in Disney’s theme parks, the court filing cites social media posts that hinted at a collaboration with Brady and includes a photo of a business card with McBride’s name and contact info featuring the NXT LVL logo alongside the logos of TB12, Disney, Star Wars and Marvel.

“Defendants knew that they did not have any real prospects of signing the ‘GOATs’ that they promised, that a number of these so-called ‘GOATs’ already were endorsing other competing products, and that they had no intention or ability to develop a successful company that would in any way conform to the company they were describing,” the complaint states. “Instead, Defendants had one motive and one motive alone: to use the Company as their own personal ‘piggy bank,’ stealing money invested by shareholders from the Company to line their own pockets.”

In addition to Sisson, plaintiffs in the suit include Swiss resident Luis Sequeira, Florida resident Isaiah Griffin and Sharmila Viswasam, a Maryland-based realtor and day trader, and the founder of Realtor Star Shar, Inc. and PR firm StarShar Media, LLC.

It was these GOAT promises, the suit claims, that allowed Takeover to secure an actual athlete partnership with Pacquiao, who was introduced to the company by Sisson and Viswasam. The complaint further adds that Pacquiao “was himself a victim” of the “fraudulent scheme” as the founders “had no intention of making all the payments due to Mr. Pacquaio under the endorsement contract” they signed or to “actually distribute the products in the volumes required to make the Company profitable.”

Takeover Industries and Labor Smart, Inc., the complaint alleged, was nothing more than a “penny stock pump and dump” scheme operating similarly to McBride and Holley’s past venture, High Performance Beverage Company (traded on OTC markets under the ticker TBEV), and Pavlik’s involvement with the companies Rejuval Biosciences, Inc. (ticker NUUU) and NNRF, Inc. (ticker NNRI).

Posting on Takeover’s official and his personal social media accounts – including Twitter handles @TakeoverInd, @TakeoverJoe and @JoePavlik – Pavlik was accused of claiming the company had partnerships with “[m]any GOATs” and assured investors in a March 2021 video that “this is not a scam” and “this is a real company.” He would reiterate the nonexistent athlete partnerships during several video interviews with online trading personality StanTheTradingMan, according to the complaint.

Meanwhile, McBride was accused of personally assuring Sisson throughout the spring that the company’s “deal” with Brady and Guerrero was still in place and would be announced publicly in due time.

The complaint also claims that Takeover issued a fraudulent press release claiming it had entered an endorsement deal with Jacksonville Jaguars tight end Chris Manhertz to promote NXT LVL when no deal existed. However, Manhertz did appear to tweet about NXT LVL in August 2021, two months after the press release was issued, commenting on a thread about the company that he was “Super hydrated [flexing arm emojis] #NXTLVL.”

BevNET attempted to reach out to Manhertz for comment through Twitter but did not receive a response.

It wasn’t just endorsement deals that Takeover allegedly lied about, either. One announcement claiming NXT LVL had gained distribution in HyVee stores was denied by the retailer, which said at the time that it never approved the news release.

As online dissent grew louder amongst shareholders, seething about the lack of official announcements regarding the company’s touted athlete partners, Pavlik began blaming posters for jeopardizing the deals.

“A few goats got slaughtered because some people couldn’t keep quiet,” he wrote.

Sisson and Luis Sequeira initially agreed to an interview with BevNET for this story, but later declined, stating they had been contacted by Takeover’s lawyers to initiate settlement discussions. “We are trying to save the company,” Sequeira said.

The Taking of Takeover

On May 25, Wisconsin resident James Deppoleto, Jr. issued a $500,000 secured convertible note purchase agreement to Takeover Industries and Labor Smart. The contract was signed by Tucker and by Michael Costello, who by then had replaced Pavlik as the CEO of Labor Smart. Deppoleto would increase his investment in the company to just over $2 million by the end of the year, making him the single largest investor in the company.

According to the lawsuit filed by Deppoleto last month, he had secured final approval over major board decisions in exchange for his investments. But when McBride and Pavlik staged a “complete takeover” of the company behind his back in November, reinstating Holley to the board of directors and firing Tucker, he called the entirety of his debt in, which he claims has still not been paid.

This apparent coup came after Tucker appeared to be making moves to oust McBride from the company. After the discovery of McBride’s excessive expense reports and his supposed involvement with Holley’s shifting funds, McBride agreed to take a 60-day unpaid administrative leave on September 21, 2022. The leave was announced on Takeover’s Twitter account two days later.

According to court filings, McBride admitted to abusing the expense system and promised to repay the company, but is alleged to have continued spending upwards of $30,000 even after his confession.

On November 10, an emergency motion was filed by lawyers for Takeover in the Arizona lawsuit against Holley. The filing, signed by attorney Veronica L. Manolio – who quickly afterwards filed a motion to withdraw as Pavlik’s counsel – states that Pavlik participated in an emergency board meeting along with McBride to terminate the 60-day leave and reinstate Holley as a director and CFO. In that meeting, the founders also voted to oust Costello as CEO of Labor Smart, fire Tucker from the company and the board, and name Pavlik as president in his place. Manolio noted that she was representing Pavlik in this particular lawsuit and said he participated in the meeting against her advice.

It’s unclear how long the plan had been in the works, but the ball began rolling as late as the prior week when McBride called for the board to meet with Holley in order to discuss the pending litigation and to nominate a new board of directors. Costello was not notified, despite him having a presiding seat as the CEO of Labor Smart, and he and Tucker “made it clear that they would not attend an improper meeting,” the filing stated.

Costello declined to comment for this story.

Once the founders had regained control of the company, they requested the counsel representing Takeover in the case against Holley turn over all financial and business information to them.

In the filing, Manolio said Takeover was on the verge of expanding its Gamer Shots line into 8,000 stores nationwide – a statement backed by Costello in a separate deposition – and she warned that the company could be on the verge of collapse as a result of the founders’ actions.

“Without the next investment of funds, Takeover will not be able to complete its manufacturing of pending orders nor install its needed displays, and it will breach its agreements with both the convenience store chain and the variety store chain,” she wrote. “Takeover will not be able to generate profit or recoup the funds necessary to pay on the Notes. Takeover’s pledged collateral will be lost, leaving the Company defunct.”

In a statement to BevNET, Tucker defended his actions at the company, writing “When the evidence appeared to point at certain individuals, I was ousted. Now, almost five months later, I understand that sales have all but stopped.”

“I will let the results during my tenure speak for themselves,” Tucker continued. “It’s a tragedy by any metric.”

Leveling Up

Takeover Industries, however, is not dead yet.

BevNET reached out to the company for comment and received a reply from an investor in Labor Smart named Tom Zarro, with McBride, Holley, Pavlik and legal counsel cc’d on the correspondence.

According to SEC documents, Zarro had been a private investor in Labor Smart years before the reverse merger and also holds securities in former CEO Ryan Schadel’s latest web3 venture Metavesco. His LinkedIn shows experience in the shipping and logistics industry.

In the email, Zarro said he is currently considering accepting an interim CEO role with Takeover and that his immediate goal for the company is to settle all outstanding legal matters. Because Zarro and the Takeover team are currently in settlement negotiations and undergoing a significant leadership restructuring, BevNET was unable to schedule a call with the company in a timely manner, but Zarro provided a written response to emailed questions.

With his direct involvement, Zarro said Takeover has worked to institute more transparency and post regular updates to shareholders through its official Twitter account, including announcements that it is working with firm BF Borgers on an audit in order to get the financial situation in order and eventually resume trading on the OTC market.

“On behalf of Takeover, I have been in touch [with] all parties involved in the company, and many shareholders,” Zarro wrote. “With that vantage point, I was able to uncover many opportunities for progress, not the least of which is communicating with the public about the status of Takeover’s ability to trade in the markets, spin out, etc. Our shareholder base has received this information very well, in fact they were craving this honesty and transparency. I personally don’t have any other way to operate.”

Although the board currently consists of the three founders, Zarro said Takeover is “in the process of reshaping our corporate Governance,” which will include adding new seats to the board of directors with “others stepping down.” The company will also be making changes to its c-suite, he said, including a new CEO, COO and CFO, while those currently in the roles (McBride and Holley) will be moving into different positions at the company. Zarro said the business is still in the process of finalizing this leadership change and could not comment further on the specifics at this time.

Takeover is also forming an advisory board panel “made up of industry experts and enthusiasts of Takeover and NXT LVL brands” and currently has brought on “a business development person, a CTO person to assist with SEO etc., a MFG and distribution expert representative, an E-sports gaming expert, and a Shareholder advocate.”

“All these positions are designed to bring strength to the company, while being transparent with our shareholders,” Zarro wrote. “Takeover will have better management, by a committee run by our board and advisors. I see this as a 10–12-person group.”

The company has also restarted the “unexplainably stalled process” to complete its audits and to submit its documentation to regulatory authorities: “I assure you and anyone reading now that this process is in high gear and will be completed (of course barring the unforeseen). Our engagements are now completed so this process has a finish line.”

Settlement discussions between the plaintiffs in the shareholders lawsuit last month are ongoing, Zarro said, but two of the four have “indicated their claims will be withdrawn from that case citing ‘new information’ that cannot be ignored as to why Takeover is where it is today.’” The other two plaintiffs, he added, are in daily conversations with the team to address their claims.

On February 5, one of the plaintiffs in that case, Viswasam, tweeted her admiration for Zarro and hoped that the investors will be able to recoup their losses and return their attention to growing the company.

“We still have a lot of work to do,” Viswasam wrote. “Please continue to pray for us as we keep chipping away at this and trying to get our investment back on track to get us trading and our start up company back to its highs! I’m happy to announce After 2 weeks [sic] of hard fought negotiations we are on the verge of a definitive agreement to a settlement. GOD IS GREAT and we will Win!”

Zarro also sought to underscore wins for the company that have been made over the past couple months. The business was able to avert another lawsuit with its manufacturing partner Faith Springs, he said, and has brought its flagship hydrogen water NXT LVL drink back to the market.

“That is a double win. Our company was founded on this product and to see this staple removed was one of the reasons we find ourselves with upset shareholders, and financial difficulty.”

Takeover is in the “final stages of shoring up our global partnerships” to sell products in Europe and Asia, Zarro said, but cautioned the deals are not yet formalized. As well, the brand’s direct-to-consumer store has resumed selling its Gamer shots alongside the canned water and two new products are currently out for sample testing. Last week, the brand was present at the CHAMPS Trade Show in Las Vegas, an event for the smoke shop, glass, vape and CBD industries.

“I truly believe the Takeover story will have a happy ending, which will be seen as a miracle once people recognize the undercurrent of infighting that took place, and to some degree continues,” Zarro concluded. “The negativity and false information has been mind boggling to me as it has been for anyone that has taken the time to truly understand how we got here.”